Molecular diagnostics uses techniques such as nucleic acid amplification and hybridization for identification of microorganisms and presence of virulence factors. Various molecular assays have been developed using various technologies. These technologies increased the accuracy of the tests, producing rapid results.

The molecular diagnostic market for group A streptococcus (GAS) nucleic acid (NA) tests in Europe is anticipated to grow at a significant rate during the forecast period due to increasing incidence of Streptococcus pyogenes infection in Europe, advancements in technology, and rising demand for point-of-care testing. The average annual incidence of GAS invasive disease has been estimated to be 2.45 per 100,000 population in developed countries. The incidence of the disease has increased at a steady rate in most countries. Advancements in nucleic acid testing technologies and their adoption in Europe would result in high growth of the market. Recent developments in the field of nucleic acid testing have led to a shift of technology from laboratory to point-of-care testing. Some of the factors restraining the market are ineffectiveness and slow adoption rate, lack of facilities, and regulatory challenges. Future technology enhancements is the major opportunity in the nucleic acid tests market.

Polymerase chain reaction is an established amplification technique for nucleic acid (NA) tests for group A streptococcus (GAS). Recently the techniques like Non-Amplified Tests such as Nucleic acid probes is getting popular due to its high specificity, and there is no risk of contamination in the sample. Isothermal nucleic acid amplification technique is being rapidly adopted due to its high adoptability over other test methods. Loop mediated amplification technique is a type of isothermal nucleic acid amplification technique that is used in identification of group A streptococcus by nucleic acid tests.

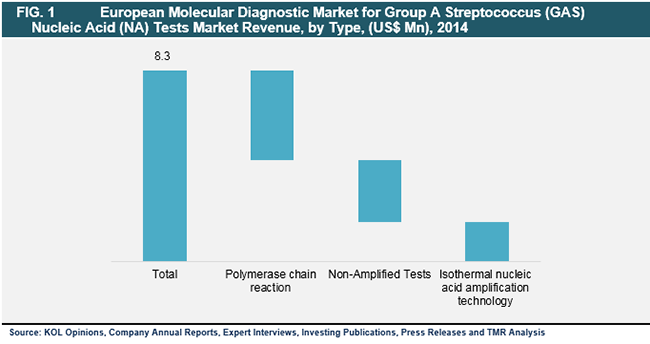

The molecular diagnostic market for group A streptococcus (GAS) nucleic acid (NA) tests in Europe has been estimated based on type of tests, end-user, and geography. Based on type of test, the market has been segmented into polymerase chain reaction, non-amplified tests, and isothermal nucleic acid amplification technology. The polymerase chain reaction segment held the largest share of the market in 2014. The segment is likely to continue to dominate the market during the forecast period. The isothermal nucleic acid amplification technology segment is estimated to record fastest growth during the forecast period due to rising need for accurate and rapid results.

Based on end-user, Molecular Diagnostic Market for Group A Streptococcus (GAS) Nucleic Acid (NA) Test Product market has been segmented into hospitals, public health laboratories, and others. The hospitals segment held the largest share of the market in 2014. The segment is likely to continue to dominate the market during the forecast period.

Geographically, the molecular diagnostic market for group A streptococcus (GAS) nucleic acid (NA) tests has been categorized into five regions: Western Europe, Northern Europe, Southern Europe, Eastern Europe, and Rest of Europe. Western Europe held the largest share of the GAS nucleic acid tests market in 2014, followed by Northern Europe. The market in the Northern region is expected to expand at a high CAGR during the forecast period. Low market revenue and growth in Eastern Europe and Rest of Europe is due to low adoption of nucleic acid tests.

Alere, Inc., Meridian Bioscience, Inc., Nanosphere, Inc., Hologic, Inc., and F. Hoffmann-La Roche Ltd. are the major players operating in the molecular diagnostic market for group A streptococcus (GAS) nucleic acid (NA) tests in Europe. F. Hoffmann-La Roche Ltd. is the leading player in the market.

Rise in COVID-19 Testing Initiatives to Accelerate the Growth Prospects of the Molecular Diagnostics Market

Molecular diagnostics has emerged as a feasible technique or method for faster disease diagnosis coupled with fewer complexities. The rising prevalence of diverse infectious diseases at a rapid rate is also a prominent reason for the increase in the demand for molecular diagnostics. Thus, all these aspects will help the molecular diagnostics market to gain a considerable growth-share during the assessment period of 2015-2023.

Table of Content

Chapter 1 Chapter 1 Introduction

1.1 Report Description

1.2 Research Methodology

1.3 Market Segmentation

Chapter 2 Executive Summary

Chapter 3 Europe Molecular Diagnostic Market for Group A Streptococcus (GAS) NA Tests Market Overview

3.1 Introduction

3.2 Market Dynamics

3.2.1 Drivers

3.2.2 Restraints

3.2.3 Opportunities

3.3 Porter’s Five Forces Analysis

3.3.1 Bargaining Power of Suppliers

3.3.2 Bargaining Power of Buyers

3.3.3 Threat of New Entrants

3.3.4 Threat of Substitutes

3.3.5 Competitive Rivalry

3.4 Patient Pool Analysis

3.4.1 Mild illness (Acute pharyngitis)

3.4.2 Severe illness (e.g. Pneumonia, necrotizing fasciitis, etc.)

3.5 Market Attractiveness Analysis: Europe Molecular Diagnostic Market for Group A Streptococcus (GAS) NA Tests Market, by Top Countries

3.6 Competitive Landscape, by Key Players, 2014

Chapter 4 Europe Molecular Diagnostic Market for Group A Streptococcus (GAS) NA Tests Market Revenue (US$ Mn), by Type of Test Technique, 2013–2023

4.1 Overview

4.2 Isothermal nucleic acid amplification technology (iNAT)

4.3 Polymerase chain reaction

4.4 Non-Amplified Tests

Chapter 5 Europe Molecular Diagnostic Market for Group A Streptococcus (GAS) NA Tests Market Revenue (US$ Mn), by End-user, 2013–2023

5.1 Overview

5.2 Hospitals

5.3 Public Health Laboratories

5.4 Others (Referenced and Clinical Laboratories)

Chapter 6 Europe Molecular Diagnostic Market for Group A Streptococcus (GAS) NA Tests Market Revenue (US$ Mn), by Major Regions and Countries, 2013–2023

6.1 Overview

6.2 Northern Europe

6.2.1 Ireland

6.2.2 Norway

6.2.3 Sweden

6.2.4 United Kingdom of Great Britain and Northern Ireland

6.2.5 Rest of Central Europe

6.3 Eastern Europe

6.3.1 Ukraine

6.3.2 Poland

6.3.3 Czech Republic

6.3.4 Russian Federation

6.3.5 Rest of Eastern Europe

6.4 Western Europe

6.4.1 France

6.4.2 Germany

6.4.3 Austria

6.4.4 Rest of Western Europe

6.5 Southern Europe

6.5.1 Italy

6.5.2 Spain

6.5.3 Portugal

6.5.4 Rest of Southern Europe

6.6 Rest of Europe (including Scandinavia, Mediterranean Europe, Azerbaijan, etc.)

Chapter 7 Current Trends and Historical Snapshot

Chapter 8 Company Profiles

8.1 Alere Inc.

8.1.1 Company Overview

8.1.2 Financial Overview

8.1.3 Product Portfolio

8.1.4 Business Strategies

8.1.5 Recent Developments

8.2 Focus Diagnostics, Inc.

8.3 F. Hoffmann-La Roche Ltd.

8.4 Hologic, Inc.

8.5 Meridian Bioscience, Inc.

8.6 Nanosphere

8.7 Quidel Corporation