Graph Database Market by Model Type (RDF, LPG, Hypergraph), Offering (Solutions, Services), Analysis Type (Community Analysis, Connectivity Analysis, Centrality Analysis, Path Analysis), Vertical, and Region - Global Forecast to 2028

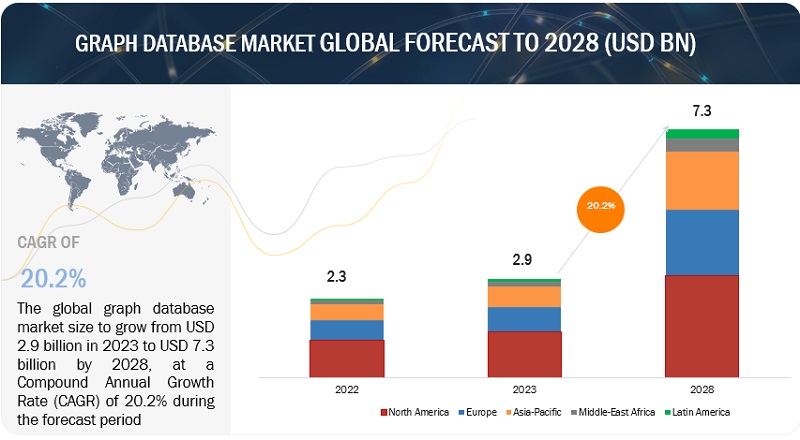

The global graph database market is estimated to be worth USD 2.9 billion in 2023. It is projected to reach USD 7.3 billion by 2028 at a CAGR of 20.2% during the forecast period. Various factors such as the exponential growth of interconnected data in modern applications, such as social networks and recommendation engines, necessitates specialized tools like graph databases to effectively capture and navigate complex relationships will drive market.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Graph Database Market Dynamics

Driver: Need to incorporate real-time big data mining with visualization of the result.

A graph database is designed to handle the relationships between complex and constantly changing data, extract insights in real time, and deliver instantly actionable insights and superior experiences. It enables accurate decision-making processes in real time and ensures that customers can focus on matters they want to prioritize. A graph database facilitates the distribution of any data across data centres or cloud regions, allowing business applications to be always-on, ready to grow, and capable of producing real-time insights and experiences. Furthermore, it aids in the visualisation of insights through data visualisations and delivers real-time forecasts for streaming data. As a result, the graph database is used to improve business processes, decision-making, and achieve the ability to automate, optimise, and guide decisions based on needs in order to meet established corporate goals.

Restraint: Lack of standardization and programming ease

Graph databases come in various flavors and implementations, each with its own query language, data modeling approach, and features. This lack of standardization can create confusion for developers and organizations looking to adopt graph databases. Graph databases allow for flexible data modeling, but this flexibility can also lead to inconsistency in how data is structured. Unlike the standardized schema of relational databases, graph databases allow each node and relationship to have different properties, making it harder to establish a common structure across different graph databases.

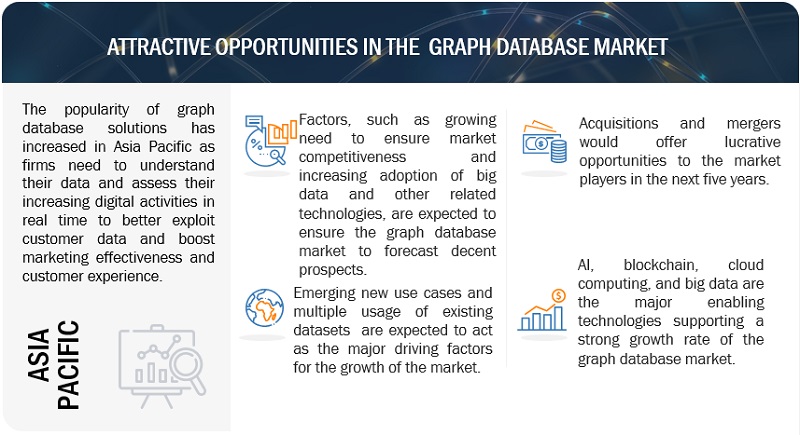

Opportunity: Enterprise data unification and rapid proliferation of knowledge graphs

Most businesses face challenges in managing and unifying data. Therefore, to better utilize it, they collect a high volume of data regarding the customers’ activity, demographics, and preferences. This usually results in the creation of vast data silos, which leads to data hoarding when left unscreened. Additionally, several organizations support a breadth of applications – legacy and new, generating distributed and disparate data difficult to manage. Data integration solutions that combine datasets are often not well-suited to changing data requirements. This leads to the inception of ‘Data unification’ deployed by businesses with vast and disparate data generation capabilities.

Knowledge graphs typically work well by unifying data and mapping relationships by drawing connections without moving or copying data, to create a seamless layer atop the existing data infrastructure. These graphs being highly scalable and able to retain each analysis, can act as a reusable asset. While other databases establish connections at the time of querying (by way of expensive JOIN operations), graph databases store the relationships with the data. An enhanced graph database, enriched with business rules enabling inference to be performed upon the connected data, enables streamlined knowledge management across an organization.

Deploying traditional data management approaches does not unearth the dynamic needs required to solve current day and age problems and is time-consuming and too expensive. This is where the application of knowledge graphs for data unification, although currently at a nascent stage, will have profound implications in business strategy excellence in the years ahead.

Challenge: Lack of technical expertise

Graph databases require a different skillset compared to traditional relational databases. Managing and optimizing graph databases involves understanding graph theory, data modeling for relationships, and specialized query languages (such as Cypher or Gremlin). Finding individuals with experience and expertise in these areas can be challenging, especially when the technology is still relatively new. Effectively modeling data in a graph database requires a deep understanding of relationships and how data elements are connected. Without expertise, organizations might struggle to create efficient and intuitive data models, leading to suboptimal performance and usability.

Graph Database Market Ecosystem

The solution segment is expected to account for a larger market size during the forecast period

The offering segment has been further divided into solution and services. The solution segment is expected to account for a larger market size during the forecast period. A graph database solution is a specialized technology designed to efficiently manage and analyze complex relationships within data. Unlike traditional databases that store information in rows and columns, graph databases utilize nodes and edges to represent entities and their connections. The driving factor behind the popularity of graph database solutions is their ability to address scenarios where relationships are as crucial as the data itself.

Hypergraphs to account for higher CAGR during the forecast period

In the graph database market, a hypergraph is a specialized data model that extends the capabilities of traditional graph databases by allowing multiple types of relationships (hyperedges) to connect any number of nodes. Unlike standard graphs, where edges link only two nodes, hypergraphs enable a more flexible representation of complex, interconnected data. The demand for more sophisticated recommendation systems that consider multi-entity interactions fuels the interest in hypergraphs.

North America to account for largest market size during the forecast period

North America is expected to have the largest market share in the graph database market. Key factors favoring the growth of the graph database market in North America include the increasing technological advancements in the region. Also, the presence of major cloud providers and technology companies in North America contributes to the accessibility and adoption of graph database services, allowing organizations to harness their benefits without significant infrastructure overhead.

Key Market Players

The graph database vendors have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global graph database market include Oracle Corporation (US), IBM Corporation (US), Amazon Web Services, Inc. (US), DataStax (US), Ontotext (Bulgaria), Stardog Union (US), Hewlett Packard Enterprise (US), ArangoDB (US), Blazegraph (US), Microsoft Corporation (US), SAP SE (Germany), Teradata Corporation (US), Openlink Software (US), TIBCO Software, Inc. (US), Neo4j, Inc. (US), GraphBase (Australia), Cambridge Semantics (US), TigerGraph, Inc. (US), Objectivity Inc. (US), Bitnine Co, Ltd. (US), Franz Inc. (US), Redis Labs (US), Graph Story (US), Dgraph Labs (US), Eccenca (Germany), and Fluree (US). The study includes an in-depth competitive analysis of these key players in the graph database market with their company profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

USD Million/Billion |

|

Segments covered |

Offering, Analysis Type, Model Type, Vertical, and Regions. |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East and Africa , and Latin America |

|

Companies covered |

Oracle Corporation (US), IBM Corporation (US), Amazon Web Services, Inc. (US), DataStax (US), Ontotext (Bulgaria), Stardog Union (US), Hewlett Packard Enterprise (US), ArangoDB (US), Blazegraph (US), Microsoft Corporation (US), SAP SE (Germany), Teradata Corporation (US), Openlink Software (US), TIBCO Software, Inc. (US), Neo4j, Inc. (US), GraphBase (Australia), Cambridge Semantics (US), TigerGraph, Inc. (US), Objectivity Inc. (US), Bitnine Co, Ltd. (US), Franz Inc. (US), Redis Labs (US), Graph Story (US), Dgraph Labs (US), Eccenca (Germany), and Fluree (US). |

This research report categorizes the graph database market based on offering, solution type, deployment mode, analysis type, model type, vertical, and regions.

By Offering:

-

Solution

- Solution Type

- Deployment mode

-

Services

- Professional Services

- Managed Services

By Analysis Type:

- Community Analysis

- Connectivity Analysis

- Centrality Analysis

- Path Analysis

By Model Type:

- RDF

- Labeled Propert Graph

- Hypergraphs

By Vertical:

- BFSI

- Retail and eCommerce

- Telecom and IT

- Healthcare, Pharmaceuticals, and Life Sciences

- Government and Public Sector

- Manufacturing and Automotive

- Media and Entertainment

- Energy and Utilities

- Travel and Hospitality

- Transportation and Logistics

- Others

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- South Korea

- ANZ

- Rest of Asia Pacific

-

Middle East and Africa

- UAE

- Saudi Arabia

- Israel

- South Africa

- Rest of Middle East and Africa

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Recent Developments:

- In May 2023, AWS and Neo4j Partner and AWS Marketplace Seller which defined the graph database space and open-source standards. Neo4j holds the AWS Data and Analytics Competency.

- In May 2023, SAP and Google Cloud announced a significant expansion of their partnership, including the introduction of a comprehensive open data offering designed to simplify data landscapes and unleash the power of business data. The new offering will bring together SAP and Google Cloud’s data and analytics technology, increasing the openness and value of enterprise data and advancing enterprise AI development.

- In April 2023, Neo4j announced partnership with Imperium Solutions to fulfil growing demand for graph technology in Singapore. Imperium Solutions will ensure customers can gain maximum value from the world’s leading graph database provider, Neo4j, who helps solve complex, enterprise-level problems and efficiently uncovers relationships and patterns in expansive datasets.

- In February 2023, IBM is announced the acquisition of StepZen Inc, which developed a GraphQL server with a unique architecture that helps developers build GraphQL APIs quickly and with less code. StepZen was also designed to be highly flexible. It is compatible with other API approaches and is available as-a-Service (SaaS) while also supporting deployments in private clouds and on-premises data centers.

- In December 2022, LSEG and Microsoft announced a 10-year strategic partnership for next-generation data and analytics solutions, as well as cloud infrastructure solutions; Microsoft will make an equity investment in LSEG through share acquisition. New collaboration with Microsoft Azure, AI, and Microsoft Teams to architect LSEG's data infrastructure and build intuitive next-generation productivity, data and analytics, and modeling solutions.

Frequently Asked Questions (FAQ):

What is graph database?

According to Neo4J, a graph database is a database designed to treat the relationships between data as equally important to the data itself. It is intended to hold data without constricting it to a pre-defined model. Instead, the data is stored as it is drawn out - showing how each individual entity connects with or is related to others.

Which countries are considered in the European region?

The report includes an analysis of the UK, Germany, and France, Italy, Spain in the European region.

Which are key verticals adopting graph database solution and services?

Key verticals adopting graph database solution and services include banking, financial services, and insurance; retail and consumer goods; IT and telecom; manufacturing and automotive; media and entertainment; healthcare, pharmaceuticals, and life sciences; government and public services; transportation and logistics; travel and hospitality; energy and utilities; and others (education, real estate, and research).

Which are the key drivers supporting the growth of the graph database market?

The graph database market's growth is propelled by the demand for real-time big data mining and visualization, the rising use of AI-driven graph database tools, and the increasing need for low-latency query processing solutions. These drivers collectively fuel the adoption of graph database solutions and services, addressing the challenges posed by complex data relationships and enabling insights in today's dynamic data landscape.

Who are the key vendors in the graph database market?

The key vendors operating in the graph database market Oracle Corporation (US), IBM Corporation (US), Amazon Web Services, Inc. (US), DataStax (US), Ontotext (Bulgaria), Stardog Union (US), Hewlett Packard Enterprise (US), ArangoDB (US), Blazegraph (US), Microsoft Corporation (US), SAP SE (Germany), These vendors have adopted different types of organic and inorganic growth strategies such as new product launches, product enhancements, partnerships, and mergers and acquisitions.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

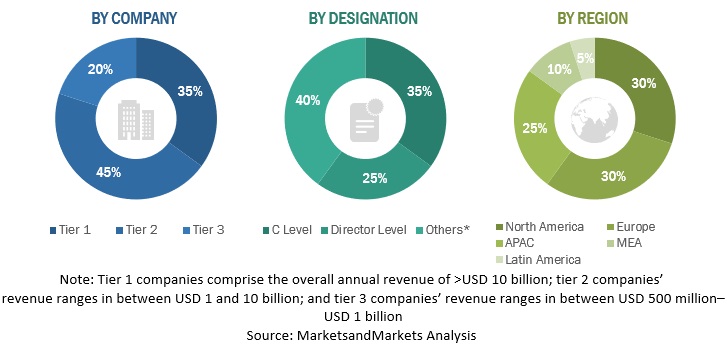

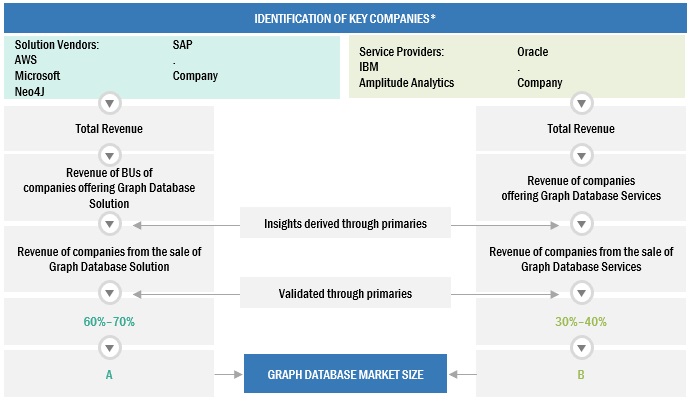

The study involved four major activities in estimating the current market size of the graph database market. Extensive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the graph database market.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, investor presentations of companies; white papers; journals; and certified publications and articles from recognized authors, directories, and databases.

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief X Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from graph database solution vendors, system integrators, professional service providers, industry associations, and consultants; and key opinion leaders. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Graph Database Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the market. The top-down approach was used to derive the revenue contribution of top vendors and their offerings in the market. The bottom-up approach was used to arrive at the overall market size of the global Graph Database market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined through primary and secondary research processes.

- All percentages, shares, and breakups were determined using secondary sources and verified through primary sources.

Top-Down Approach

In the top-down approach, an exhaustive list of all the vendors offering solutions and services in the graph database market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor's offerings were evaluated based on the breadth of solutions and services, deployment modes, applications, and verticals. The aggregate of all the companies’ revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation.

Bottom-Up Approach

In the bottom-up approach, the adoption rate of graph database solutions among different end users in key countries with respect to their regions contributing the most to the market share was identified. For cross-validation, the adoption of graph database solutions and services among industries, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the graph database market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major graph database providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, the exact values of the overall graph database market size and segments’ size were determined and confirmed using the study.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Definition

According to Neo4J, a graph database is a database designed to treat the relationships between data as equally important to the data itself. It is intended to hold data without constricting it to a pre-defined model. Instead, the data is stored as it is drawn out - showing how each individual entity connects with or is related to others.

Stakeholders

- Graph Database Solution Providers

- Independent Software Vendors (ISVs)

- Investors and Venture Capitalists (VCs)

- Managed Service Providers

- Support and Maintenance Service Providers

- System Integrators (SIs)/Migration Service Providers

- Value-Added Resellers (VARs) and Distributors

Report Objectives

- To define, describe, and predict the graph database market by solution, services, model type, analysis type, vertical, and region

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To track and analyze competitive developments, such as acquisitions, expansions; product launches and product enhancements; agreements, collaborations, and partnerships; and R&D activities in the market.

- To analyze the impact of recession across all the regions across the graph database market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American graph database market

- Further breakup of the European market

- Further breakup of the APAC market

- Further breakup of the Latin American market

- Further breakup of the MEA market

Company Information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Graph Database Market