Saudi Arabia In-Vitro Diagnostics Market, Size, Forecast 2024-2030, Industry Trends, Growth, Share, Outlook, Impact of Inflation, Opportunity Company Analysis

Saudi Arabia IVD Market Outlook

Saudi Arabia IVD Market is projected to be valued at around US$ 1.48 Billion by 2030, according to Renub Research. In modern days, in vitro diagnostics (IVD) are used to monitor an individual’s overall health. IVD are tests or examinations conducted on samples retrieved from the human body, such as blood or tissue samples. “In vitro,” meaning “in glass,” indicates that these tests generally use equipment like test tubes or Petri dishes. IVD is a non-invasive tool that can detect and prevent diseases. Consumers can use it in healthcare settings or at home. Also, healthcare professionals can utilize it for precision medicine to determine the best course of treatment for certain patients.

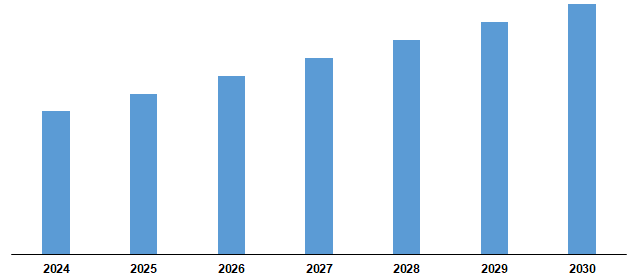

Saudi Arabia In-Vitro Diagnostics (IVD) Market Size, 2024-2030 (Billion US$)

Note: The chart above shows dummy data and is only for illustration purposes. Please get in touch with us for the actual market size and trends.

Saudi Arabia IVD Market is predicted to undergo a CAGR of 4.33% between 2024 and 2030

The increasing incidence of chronic and infectious disorders is driving an expanding market. For instance, in Makkah, Saudi Arabia, anemia affects 38.7% of the population, with a higher prevalence among females. Non-alcoholic fatty liver disease affects 16.6% of the general population in Saudi Arabia. Consequently, there is a growing demand for clinical chemistry and body fluid assay techniques to diagnose these disorders accurately. Technological advancements and using biomarkers have improved the accuracy and yield of clinical chemistry-based diagnostic tests.

Immunodiagnostics has witnessed brilliant improvements in the in vitro diagnostics market in Saudi Arabia. The convergence of revolutionary technology and a developing emphasis on healthcare has fuelled this progress. Integrating automatic structures, like ELISA platforms, has more desirable efficiency and accuracy of IVD assessments, bearing in mind the fast and reliable detection of various sicknesses. Moreover, using novel biomarkers and monoclonal antibodies has extended diagnostic abilities, permitting early disorder identification and customized remedy techniques. Hence, the Saudi Arabia IVD market was worth US$ 1.10 Billion in 2023.

The collaboration between research institutions, healthcare providers, and industry players has facilitated the development of indigenous immunodiagnostic solutions tailored to regional healthcare needs. According to a report by the International Trade Administration, the Saudi Arabian Government planned to spend USD 36.8 million on healthcare and social development. The Saudi Arabian healthcare market has seen a considerable increase in the various sections because of multiplied investments by of the government authorities and personal organizations. This has led to higher adoption costs of advanced diagnostic gadgets, like in-vitro diagnostic units.

ELISA and CLIA tests hold a substantial share in the Saudi Arabia IVD market

By the test types, the Saudi Arabia IVD market is fragmented into ELISA & CLIA, PCR, Rapid Test, Fluorescence Immunoassays (FIA), In Situ Hybridization, Transcription Mediated Amplification, Sequencing, Colorimetric Immunoassay, Radioimmunoassay (RIA), Isothermal Nucleic Acid Amplification Technology, and Others. ELISA and CLIA tests are positioned for growth in the Saudi Arabia IVD market. As chronic and infectious diseases become more widespread, unique diagnostic solutions are needed. These tests are necessary for disease detection and monitoring because of their high sensitivity and specificity. Moreover, the growth of the Saudi Arabia IVD market is propelled by improved healthcare spending, advancements in technology, and the expansion of healthcare infrastructure, all contributing to the adoption of ELISA and CLIA tests.

The market for in vitro diagnostic (IVD) products in Saudi Arabia has seen a rise in instrument offerings

By products, the Saudi Arabia IVD market is categorized into Reagents, Instruments, and Services. The Saudi Arabia IVD market witnessed an increase in instrument products. Increasing healthcare spending, rising incidence of chronic diseases, and a growing elderly population drive demand for advanced diagnostic solutions. Instruments, which include immunoassay analyzers, molecular diagnostic units, and point-of-care testing devices, have prominence for accuracy and performance in ailment detection. Also, government projects to improve healthcare infrastructure and provide early illness analysis contribute to expanding instruments in the Saudi Arabia IVD market.

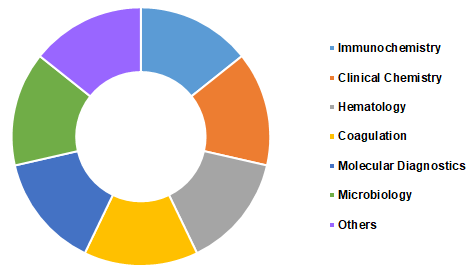

Clinical chemistry field is expected to drive growth in the market for in vitro diagnostics (IVD) in Saudi Arabia

By application, the Saudi Arabia IVD market is segmented into Immunochemistry, Clinical Chemistry, Hematology, Coagulation, Molecular Diagnostics, Microbiology, and Others. The market is anticipated to enjoy a surge in clinical chemistry. With a developing burden of chronic illnesses like diabetes and cardiovascular issues, demand rises for diagnostic checks to display the patient's health. Clinical chemistry analyzers are pivotal in assessing diverse biomarkers, aiding disorder diagnosis and treatment tracking. Moreover, technological advancements enhance the accuracy and performance of those analyzers, further fueling their adoption in the Saudi Arabia IVD market.

Key Players

Roche Diagnostics, Danaher Corporation, Abbott Laboratories, Thermo Fischer Scientific, Bio–Rad Laboratories, Inc., Sysmex Corporation, Becton, and Biomerieux are present in the Saudi Arabia IVD Market.

- In December 2022 - bioMerieux announced that VIDAS KUBE received a CE marking. VIDAS simplifies immunoassays, offering laboratories a simple, automated, and robust system that delivers fast and reliable results. VIDAS is being used in 160 countries and 25k labs worldwide and is one of the most widely used immunoassay systems in clinical labs globally.

- In April 2023 - Oxford Nanopore Technologies and bioMerieux are partnering to bring nanopore sequencing to infectious disease diagnostics to improve global health outcomes.

Renub Research report titled “Saudi Arabia IVD Market By Test Types (ELISA & CLIA, PCR, Rapid Test, Fluorescence Immunoassays (FIA), In Situ Hybridization, Transcription Mediated Amplification, Sequencing, Colorimetric Immunoassay, Radioimmunoassay (RIA), Isothermal Nucleic Acid Amplification Technology, and Others), Products (Reagents, Instruments, and Services), Application (Immunochemistry, Clinical Chemistry, Hematology, Coagulation, Molecular Diagnostics, Microbiology, and Others), Company Analysis (Roche Diagnostics, Danaher Corporation, Abbott Laboratories, Thermo Fischer Scientific, Bio–Rad Laboratories, Inc., Sysmex Corporation, Becton, and Biomerieux)” provides a complete study of Saudi Arabia IVD Industry.

Saudi Arabia In-Vitro Diagnostics (IVD) Market Share, By Application (Percentage)

Note: The chart above shows dummy data and is only for illustration purposes. Please get in touch with us for the actual market size and trends.

Test Types – Saudi Arabia IVD Market breakup in 11 viewpoints:

1. ELISA & CLIA

2. PCR

3. Rapid Test

4. Fluorescence Immunoassays (FIA)

5. In Situ Hybridization

6. Transcription Mediated Amplification

7. Sequencing

8. Colorimetric Immunoassay

9. Radioimmunoassay (RIA)

10. Isothermal Nucleic Acid Amplification Technology

11. Others

Products – Saudi Arabia IVD Market breakup in 3 viewpoints:

1. Reagents

2. Instruments

3. Services

Application – Saudi Arabia IVD Market breakup in 7 viewpoints:

1. Immunochemistry

2. Clinical Chemistry

3. Hematology

4. Coagulation

5. Molecular Diagnostics

6. Microbiology

7. Others

All the Key players have been covered from 3 Viewpoints:

• Overview

• Recent Development

• Revenue Analysis

Company Analysis:

1. Roche Diagnostics

2. Danaher Corporation

3. Abbott Laboratories

4. Thermo Fischer Scientific

5. Bio–Rad Laboratories, Inc.

6. Sysmex Corporation

7. Becton

8. Biomerieux

Report Details:

| Report Features | Details |

| Base Year | 2023 |

| Historical Period | 2019 - 2023 |

| Forecast Period | 2024 - 2030 |

| Market | US$ Billion |

| Segment Covered | Test Types, Products, and Application |

| Companies Covered | Roche Diagnostics, Danaher Corporation, Abbott Laboratories, Thermo Fischer Scientific, Bio–Rad Laboratories, Inc., Sysmex Corporation, Becton, and Biomerieux |

| Customization Scope | 20% Free Customization |

| Post-Sale Analyst Support | 1 Year (52 Weeks) |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Saudi Arabia In-Vitro Diagnostics (IVD) Market

6. Market Share – Saudi Arabia In-Vitro Diagnostics (IVD)

6.1 By Test Types

6.2 By Products

6.3 By Application

7. Test Types – Saudi Arabia In-Vitro Diagnostics (IVD) Market

7.1 ELISA & CLIA

7.2 PCR

7.3 Rapid Test

7.4 Fluorescence Immunoassays (FIA)

7.5 In Situ Hybridization

7.6 Transcription Mediated Amplification

7.7 Sequencing

7.8 Colorimetric Immunoassay

7.9 Radioimmunoassay (RIA)

7.10 Isothermal Nucleic Acid Amplification Technology

7.11 Others

8. Products – Saudi Arabia In-Vitro Diagnostics (IVD) Market

8.1 Reagents

8.2 Instruments

8.3 Services

9. Application – Saudi Arabia In-Vitro Diagnostics (IVD) Market

9.1 Immunochemistry

9.2 Clinical Chemistry

9.3 Hematology

9.4 Coagulation

9.5 Molecular Diagnostics

9.6 Microbiology

9.7 Others

10. Porter's Five Forces Analysis – Saudi Arabia In-Vitro Diagnostics (IVD) Market

10.1 Threat of New Entry

10.2 The Bargaining Power of Buyer

10.3 Threat of Substitution

10.4 The Bargaining Power of Supplier

10.5 Competitive Rivalry

11. SWOT Analysis – Saudi Arabia In-Vitro Diagnostics (IVD) Market

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Key Players Analysis

12.1 Roche Diagnostics

12.1.1 Overview

12.1.2 Recent Development

12.1.3 Revenue

12.2 Danaher Corporation

12.2.1 Overview

12.2.2 Recent Development

12.2.3 Revenue

12.3 Abbott Laboratories

12.3.1 Overview

12.3.2 Recent Development

12.3.3 Revenue

12.4 Thermo Fischer Scientific

12.4.1 Overview

12.4.2 Recent Development

12.4.3 Revenue

12.5 Bio–Rad Laboratories, Inc

12.5.1 Overview

12.5.2 Recent Development

12.5.3 Revenue

12.6 Sysmex Corporation

12.6.1 Overview

12.6.2 Recent Development

12.6.3 Revenue

12.7 Becton

12.7.1 Overview

12.7.2 Recent Development

12.7.3 Revenue

12.8 Biomerieux

12.8.1 Overview

12.8.2 Recent Development

12.8.3 Revenue

List of Figures:

Figure-01: Saudi Arabia – In-Vitro Diagnostics (IVD) Market (Billion US$), 2019 – 2023

Figure-02: Saudi Arabia – Forecast for In-Vitro Diagnostics (IVD) Market (Billion US$), 2024 – 2030

Figure-03: Test Type – ELISA & CLIA Market (Million US$), 2019 – 2023

Figure-04: Test Type – Forecast for ELISA & CLIA Market (Million US$), 2024 – 2030

Figure-05: Test Type – PCR Market (Million US$), 2019 – 2023

Figure-06: Test Type – Forecast for PCR Market (Million US$), 2024 – 2030

Figure-07: Test Type – Rapid Test Market (Million US$), 2019 – 2023

Figure-08: Test Type – Forecast for Rapid Test Market (Million US$), 2024 – 2030

Figure-09: Test Type – Fluorescence Immunoassays (FIA) Market (Million US$), 2019 – 2023

Figure-10: Test Type – Forecast for Fluorescence Immunoassays (FIA) Market (Million US$), 2024 – 2030

Figure-11: Test Type – In Situ Hybridization Market (Million US$), 2019 – 2023

Figure-12: Test Type – Forecast for In Situ Hybridization Market (Million US$), 2024 – 2030

Figure-13: Test Type – Transcription Mediated Amplification Market (Million US$), 2019 – 2023

Figure-14: Test Type – Forecast for Transcription Mediated Amplification Market (Million US$), 2024 – 2030

Figure-15: Test Type – Sequencing Market (Million US$), 2019 – 2023

Figure-16: Test Type – Forecast for Sequencing Market (Million US$), 2024 – 2030

Figure-17: Test Type – Colorimetric Immunoassay Market (Million US$), 2019 – 2023

Figure-18: Test Type – Forecast for Colorimetric Immunoassay Market (Million US$), 2024 – 2030

Figure-19: Test Type – Radioimmunoassay (RIA) Market (Million US$), 2019 – 2023

Figure-20: Test Type – Forecast for Radioimmunoassay (RIA) Market (Million US$), 2024 – 2030

Figure-21: Test Type – Isothermal Nucleic Acid Amplification Technology Market (Million US$), 2019 – 2023

Figure-22: Test Type – Forecast for Isothermal Nucleic Acid Amplification Technology Market (Million US$), 2024 – 2030

Figure-23: Test Type – Others Market (Million US$), 2019 – 2023

Figure-24: Test Type – Forecast for Others Market (Million US$), 2024 – 2030

Figure-25: Product – Reagents Market (Million US$), 2019 – 2023

Figure-26: Product – Forecast for Reagents Market (Million US$), 2024 – 2030

Figure-27: Product – Instruments Market (Million US$), 2019 – 2023

Figure-28: Product – Forecast for Instruments Market (Million US$), 2024 – 2030

Figure-29: Product – Services Market (Million US$), 2019 – 2023

Figure-30: Product – Forecast for Services Market (Million US$), 2024 – 2030

Figure-31: Application – Immunochemistry Market (Million US$), 2019 – 2023

Figure-32: Application – Forecast for Immunochemistry Market (Million US$), 2024 – 2030

Figure-33: Application – Clinical Chemistry Market (Million US$), 2019 – 2023

Figure-34: Application – Forecast for Clinical Chemistry Market (Million US$), 2024 – 2030

Figure-35: Application – Hematology Market (Million US$), 2019 – 2023

Figure-36: Application – Forecast for Hematology Market (Million US$), 2024 – 2030

Figure-37: Application – Coagulation Market (Million US$), 2019 – 2023

Figure-38: Application – Forecast for Coagulation Market (Million US$), 2024 – 2030

Figure-39: Application – Molecular Diagnostics Market (Million US$), 2019 – 2023

Figure-40: Application – Forecast for Molecular Diagnostics Market (Million US$), 2024 – 2030

Figure-41: Application – Microbiology Market (Million US$), 2019 – 2023

Figure-42: Application – Forecast for Microbiology Market (Million US$), 2024 – 2030

Figure-43: Application – Others Market (Million US$), 2019 – 2023

Figure-44: Application – Forecast for Others Market (Million US$), 2024 – 2030

Figure-45: Roche Diagnostics – Global Revenue (Million US$), 2019 – 2023

Figure-46: Roche Diagnostics – Forecast for Global Revenue (Million US$), 2024 – 2030

Figure-47: Danaher Corporation – Global Revenue (Million US$), 2019 – 2023

Figure-48: Danaher Corporation – Forecast for Global Revenue (Million US$), 2024 – 2030

Figure-49: Abbott Laboratories – Global Revenue (Million US$), 2019 – 2023

Figure-50: Abbott Laboratories – Forecast for Global Revenue (Million US$), 2024 – 2030

Figure-51: Thermo Fischer Scientific – Global Revenue (Million US$), 2019 – 2023

Figure-52: Thermo Fischer Scientific – Forecast for Global Revenue (Million US$), 2024 – 2030

Figure-53: Bio–Rad Laboratories, Inc – Global Revenue (Million US$), 2019 – 2023

Figure-54: Bio–Rad Laboratories, Inc – Forecast for Global Revenue (Million US$), 2024 – 2030

Figure-55: Sysmex Corporation – Global Revenue (Million US$), 2019 – 2023

Figure-56: Sysmex Corporation – Forecast for Global Revenue (Million US$), 2024 – 2030

Figure-57: Becton – Global Revenue (Million US$), 2019 – 2023

Figure-58: Becton – Forecast for Global Revenue (Million US$), 2024 – 2030

Figure-59: Biomerieux – Global Revenue (Million US$), 2019 – 2023

Figure-60: Biomerieux – Forecast for Global Revenue (Million US$), 2024 – 2030

List of Tables:

Table-01: Saudi Arabia – In-Vitro Diagnostics Market Share by Test Types (Percent), 2019 – 2023

Table-02: Saudi Arabia – Forecast for In-Vitro Diagnostics Market Share by Test Types (Percent), 2024 – 2030

Table-03: Saudi Arabia – In-Vitro Diagnostics Market Share by Products (Percent), 2019 – 2023

Table-04: Saudi Arabia – Forecast for In-Vitro Diagnostics Market Share by Products (Percent), 2024 – 2030

Table-05: Saudi Arabia – In-Vitro Diagnostics Market Share by Application (Percent), 2019 – 2023

Table-06: Saudi Arabia – Forecast for In-Vitro Diagnostics Market Share by Application (Percent), 2024 – 2030

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com