Analyst Viewpoint

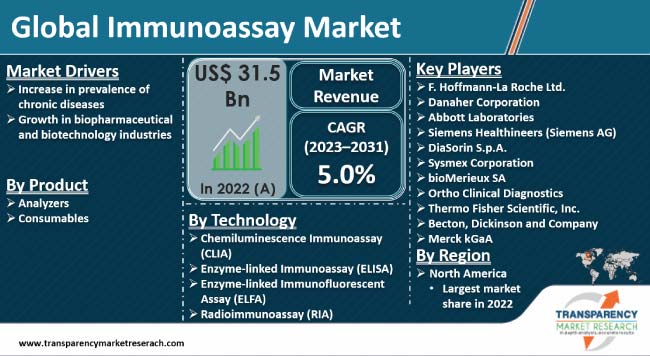

Increase in prevalence of chronic diseases and growth in biopharmaceutical and biotechnology industries are propelling the immunoassay market progress. Immunoassays are gaining popularity in the treatment of cancer, diabetes, and other chronic diseases. Growth in geriatric population is also boosting demand for immunoassays.

Rise in concerns regarding food contamination and lack of hygiene is likely to offer lucrative immunoassay market opportunities to key players. Leading players in the industry are investing in innovative drug development techniques to expand their product portfolio. They are also developing compact and innovative analyzers for mid to high-workflow laboratories.

Immunoassays or immunologic assays detect the presence of a specific molecule in a sample using antibody-antigen binding reactions. Immunoassays play a crucial role in several bioanalytical methodologies such as food monitoring, biopharmaceutical analysis, environmental monitoring and security, immune system tests, and clinical diagnostics. Immunoassays are developed to provide quantitative, semiquantitative, or qualitative detection of analytes.

Immunoassay testing works by utilizing antibodies to detect small biological substances in the blood and other bodily fluids. One of the popular methods of antibody testing is lateral flow immunoassay. Lateral flow immunoassay is a membrane-based technique to detect specific analytes in complex samples. High sensitivity and specificity, simple and user-friendly operation, and low sample volume requirement are major advantages of lateral flow immunoassay.

Changes in eating habits, sedentary lifestyles, and physical inactivity are leading to a surge in the prevalence of chronic diseases among the population. Immunoassay techniques are used to diagnose various chronic diseases including cardiovascular diseases, cancer, diabetes, nephrological diseases, mellitus, autoimmune diseases, and infections.

Growth in prevalence of cancer is propelling the immunoassay industry growth. According to the World Health Organization, cancer is a leading cause of fatalities globally and accounted for around 10 million deaths in 2020. The most common types of cancer diagnosed are lung, rectum and prostate, and breast cancers.

Cancer diagnosis is done using immunoassay techniques by analyzing genes, proteins, and other substances called tumor markers or biomarkers. Immunoassay techniques for cancer biomarkers are adopted to ensure early detection and accuracy of diagnosis. Thus, rise in demand for immunoassays in cancer diagnosis is driving the market dynamics.

Immunoassay are utilized in gene and cell therapy and vaccine development. Immunoassays provide a powerful and versatile analytical toolset in biopharmaceutical analysis, allowing manufacturers and researchers to assess the potency, safety, and quality of biopharmaceutical drugs. Public healthcare organizations and governments in various countries are investing in drug development, which is bolstering the immunoassay market size.

Immunoassays are extensively used for food toxins such as mycotoxins, pesticide residues, identification of bacteria and viruses, process-induced toxins and drugs, and detection of allergens in food. Food testing activities are increasing in the food & beverage sector due to the implementation of stringent government regulations on food safety. Hence, increase in awareness about maintaining food hygiene is boosting the market development.

As per the latest market insights, North America accounted for the largest market share in 2022. Increase in prevalence of infectious and chronic diseases and growth in geriatric population are augmenting the market expansion. Moreover, rapid development in healthcare infrastructure and surge in investment in drug development technologies are likely to bolster the immunoassay market share in the next few years.

According to the Pharmaceutical Research and Manufacturers of America, companies in the biopharmaceutical industry invested around US$ 102.3 Bn in research for drug development in 2021. As per the latest immunoassay market forecast, increase in research and development of advanced therapies for the treatment of chronic and cardiovascular diseases is projected to fuel the market value in the near future.

Leading companies are following innovative immunoassay market trends to launch new diagnostic products. They are forming strategic partnerships and mergers to enhance their production capacities and broaden their presence in global markets. Key players are adopting advanced methodologies for the diagnosis and treatment of infectious diseases to improve business performance. They are also offering immunoassay techniques for cancer biomarkers.

Some of the players in the industry are F. Hoffmann-La Roche Ltd., Danaher Corporation, Abbott Laboratories, Siemens Healthineers (Siemens AG), DiaSorin S.p.A., Sysmex Corporation, bioMerieux SA, Ortho Clinical Diagnostics, Thermo Fisher Scientific, Inc., Becton, Dickinson and Company, and Merck kGaA.

These companies are profiled in the immunoassay industry report based on various parameters including company overview, business segments, product portfolio, recent developments, business strategies, and financial overview.

| Attribute | Detail |

|---|---|

| Market Size in 2022 | US$ 31.5 Bn |

| Market Forecast (Value) in 2031 | US$ 48.7 Bn |

| Growth Rate (CAGR) | 5.0% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Tons | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces Analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 31.5 Bn in 2022

It is projected to register a CAGR of 5.0% from 2023 to 2031

Increase in prevalence of chronic diseases and growth in biopharmaceutical and biotechnology industries

North America was the most lucrative region in 2022

F. Hoffmann-La Roche Ltd., Danaher Corporation, Abbott Laboratories, Siemens Healthineers (Siemens AG), DiaSorin S.p.A., Sysmex Corporation, bioMerieux SA, Ortho Clinical Diagnostics, Thermo Fisher Scientific, Inc., Becton, Dickinson and Company, and Merck kGaA

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Immunoassay Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Immunoassay Market Analysis and Forecast, 2017-2031

5. Key Insights

5.1. Pipeline Analysis

5.2. Key Product/Brand Analysis

5.3. Key Mergers & Acquisitions

5.4. COVID-19 Pandemic Impact on Industry

6. Global Immunoassay Market Analysis and Forecast, by Product

6.1. Introduction and Definitions

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product, 2017–2031

6.3.1. Analyzers

6.3.2. Consumables

6.4. Market Attractiveness, by Product

7. Global Immunoassay Market Analysis and Forecast, by Technology

7.1. Introduction and Definitions

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Technology, 2017–2031

7.3.1. Chemiluminescence Immunoassay (CLIA)

7.3.2. Enzyme-linked Immunoassay (ELISA)

7.3.3. Enzyme-linked Immunofluorescent Assay (ELFA)

7.3.4. Radioimmunoassay (RIA)

7.3.5. Others

7.3.6. 7.4 Market Attractiveness, by Technology

8. Global Immunoassay Market Analysis and Forecast, by Application

8.1. Introduction and Definitions

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Application, 2017–2031

8.3.1. Infectious Disease

8.3.2. Endocrinology

8.3.3. Oncology

8.3.4. Cardiology

8.3.5. Orthopedics

8.3.6. Others

8.4. Market Attractiveness, by Application

9. Global Immunoassay Market Analysis and Forecast, by End-user

9.1. Introduction and Definitions

9.2. Key Findings/Developments

9.3. Market Value Forecast, by End-user, 2017–2031

9.3.1. Hospitals & Diagnostic Laboratories

9.3.2. Blood Banks

9.3.3. Others

9.4. Market Attractiveness, by End-user

10. Global Immunoassay Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region, 2017–2031

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness, by Region

11. North America Immunoassay Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017–2031

11.2.1. Analyzers

11.2.2. Consumables

11.3. Market Attractiveness, by Product

11.4. Market Value Forecast, by Technology, 2017–2031

11.4.1. Chemiluminescence Immunoassay (CLIA)

11.4.2. Enzyme-linked Immunoassay (ELISA)

11.4.3. Enzyme-linked Immunofluorescent Assay (ELFA)

11.4.4. Radioimmunoassay (RIA)

11.4.5. Others

11.5. Market Attractiveness, by Technology

11.6. Market Value Forecast, by Application, 2017–2031

11.6.1. Infectious Disease

11.6.2. Endocrinology

11.6.3. Oncology

11.6.4. Cardiology

11.6.5. Orthopedics

11.6.6. Others

11.7. Market Attractiveness, by Application

11.8. Market Value Forecast, by End-user, 2017–2031

11.8.1. Hospitals & Diagnostic Laboratories

11.8.2. Blood Banks

11.8.3. Others

11.9. Market Attractiveness, by End-user

11.10. Market Value Forecast, by Country/Sub-region, 2017–2031

11.10.1. U.S.

11.10.2. Canada

11.11. Market Attractiveness Analysis

11.11.1. By Product

11.11.2. By Technology

11.11.3. By Application

11.11.4. By End-user

11.11.5. By Country

12. Europe Immunoassay Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017–2031

12.2.1. Analyzers

12.2.2. Consumables

12.3. Market Attractiveness, by Product

12.4. Market Value Forecast, by Technology, 2017–2031

12.4.1. Chemiluminescence Immunoassay (CLIA)

12.4.2. Enzyme-linked Immunoassay (ELISA)

12.4.3. Enzyme-linked Immunofluorescent Assay (ELFA)

12.4.4. Radioimmunoassay (RIA)

12.4.5. Others

12.5. Market Attractiveness, by Technology

12.6. Market Value Forecast, by Application, 2017–2031

12.6.1. Infectious Disease

12.6.2. Endocrinology

12.6.3. Oncology

12.6.4. Cardiology

12.6.5. Orthopedics

12.6.6. Others

12.7. Market Attractiveness, by Application

12.8. Market Value Forecast, by End-user, 2017–2031

12.8.1. Hospitals & Diagnostic Laboratories

12.8.2. Blood Banks

12.8.3. Others

12.9. Market Attractiveness, by End-user

12.10. Market Value Forecast, by Country/Sub-region, 2017–2031

12.10.1. Germany

12.10.2. U.K.

12.10.3. France

12.10.4. Italy

12.10.5. Spain

12.10.6. Rest of Europe

12.11. Market Attractiveness Analysis

12.11.1. By Product

12.11.2. By Technology

12.11.3. By Application

12.11.4. By End-user

12.11.5. By Country/Sub-region

13. Asia Pacific Immunoassay Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017–2031

13.2.1. Analyzers

13.2.2. Consumables

13.3. Market Attractiveness, by Product

13.4. Market Value Forecast, by Technology, 2017–2031

13.4.1. Chemiluminescence Immunoassay (CLIA)

13.4.2. Enzyme-linked Immunoassay (ELISA)

13.4.3. Enzyme-linked Immunofluorescent Assay (ELFA)

13.4.4. Radioimmunoassay (RIA)

13.4.5. Others

13.5. Market Attractiveness, by Technology

13.6. Market Value Forecast, by Application, 2017–2031

13.6.1. Infectious Disease

13.6.2. Endocrinology

13.6.3. Oncology

13.6.4. Cardiology

13.6.5. Orthopedics

13.6.6. Others

13.7. Market Attractiveness, by Application

13.8. Market Value Forecast, by End-user, 2017–2031

13.8.1. Hospitals & Diagnostic Laboratories

13.8.2. Blood Banks

13.8.3. Others

13.9. Market Attractiveness, by End-user

13.10. Market Value Forecast, by Country/Sub-region, 2017–2031

13.10.1. China

13.10.2. Japan

13.10.3. India

13.10.4. Australia & New Zealand

13.10.5. Rest of Asia Pacific

13.11. Market Attractiveness Analysis

13.11.1. By Product

13.11.2. By Technology

13.11.3. By Application

13.11.4. By End-user

13.11.5. By Country/Sub-region

14. Latin America Immunoassay Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product, 2017–2031

14.2.1. Analyzers

14.2.2. Consumables

14.3. Market Attractiveness, by Product

14.4. Market Value Forecast, by Technology, 2017–2031

14.4.1. Chemiluminescence Immunoassay (CLIA)

14.4.2. Enzyme-linked Immunoassay (ELISA)

14.4.3. Enzyme-linked Immunofluorescent Assay (ELFA)

14.4.4. Radioimmunoassay (RIA)

14.4.5. Others

14.5. Market Attractiveness, by Technology

14.6. Market Value Forecast, by Application, 2017–2031

14.6.1. Infectious Disease

14.6.2. Endocrinology

14.6.3. Oncology

14.6.4. Cardiology

14.6.5. Orthopedics

14.6.6. Others

14.7. Market Attractiveness, by Application

14.8. Market Value Forecast, by End-user, 2017–2031

14.8.1. Hospitals & Diagnostic Laboratories

14.8.2. Blood Banks

14.8.3. Others

14.9. Market Attractiveness, by End-user

14.10. Market Value Forecast, by Country/Sub-region, 2017–2031

14.10.1. Brazil

14.10.2. Mexico

14.10.3. Rest of Latin America

14.11. Market Attractiveness Analysis

14.11.1. By Product

14.11.2. By Technology

14.11.3. By Application

14.11.4. By End-user

14.11.5. By Country/Sub-region

15. Middle East & Africa Immunoassay Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Product, 2017–2031

15.2.1. Analyzers

15.2.2. Consumables

15.3. Market Attractiveness, by Product

15.4. Market Value Forecast, by Technology, 2017–2031

15.4.1. Chemiluminescence Immunoassay (CLIA)

15.4.2. Enzyme-linked Immunoassay (ELISA)

15.4.3. Enzyme-linked Immunofluorescent Assay (ELFA)

15.4.4. Radioimmunoassay (RIA)

15.4.5. Others

15.5. Market Attractiveness, by Technology

15.6. Market Value Forecast, by Application, 2017–2031

15.6.1. Infectious Disease

15.6.2. Endocrinology

15.6.3. Oncology

15.6.4. Cardiology

15.6.5. Orthopedics

15.6.6. Others

15.7. Market Attractiveness, by Application

15.8. Market Value Forecast, by End-user, 2017–2031

15.8.1. Hospitals & Diagnostic Laboratories

15.8.2. Blood Banks

15.8.3. Others

15.9. Market Attractiveness, by End-user

15.10. Market Value Forecast, by Country/Sub-region, 2017–2031

15.10.1. GCC Countries

15.10.2. South Africa

15.10.3. Rest of Middle East & Africa

15.11. Market Attractiveness Analysis

15.11.1. By Product

15.11.2. By Technology

15.11.3. By Application

15.11.4. By End-user

15.11.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player – Competition Matrix (By Tier and Size of Companies)

16.2. Market Share Analysis, by Company (2022)

16.3. Company Profiles

16.3.1. F. Hoffmann-La Roche Ltd.

16.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.1.2. Product Portfolio

16.3.1.3. Financial Overview

16.3.1.4. SWOT Analysis

16.3.1.5. Strategic Overview

16.3.2. Danaher Corporation

16.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.2.2. Product Portfolio

16.3.2.3. Financial Overview

16.3.2.4. SWOT Analysis

16.3.2.5. Strategic Overview

16.3.3. Abbott Laboratories

16.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.3.2. Product Portfolio

16.3.3.3. Financial Overview

16.3.3.4. SWOT Analysis

16.3.3.5. Strategic Overview

16.3.4. Siemens Healthineers (Siemens AG)

16.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.4.2. Product Portfolio

16.3.4.3. Financial Overview

16.3.4.4. SWOT Analysis

16.3.4.5. Strategic Overview

16.3.5. DiaSorin S.p.A.

16.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.5.2. Product Portfolio

16.3.5.3. Financial Overview

16.3.5.4. SWOT Analysis

16.3.5.5. Strategic Overview

16.3.6. Sysmex Corporation

16.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.6.2. Product Portfolio

16.3.6.3. Financial Overview

16.3.6.4. SWOT Analysis

16.3.6.5. Strategic Overview

16.3.7. bioMerieux SA

16.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.7.2. Product Portfolio

16.3.7.3. Financial Overview

16.3.7.4. SWOT Analysis

16.3.7.5. Strategic Overview

16.3.8. Ortho Clinical Diagnostics

16.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.8.2. Product Portfolio

16.3.8.3. Financial Overview

16.3.8.4. SWOT Analysis

16.3.8.5. Strategic Overview

16.3.9. Thermo Fisher Scientific, Inc.

16.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.9.2. Product Portfolio

16.3.9.3. Financial Overview

16.3.9.4. SWOT Analysis

16.3.9.5. Strategic Overview

16.3.10. Becton, Dickinson and Company

16.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.10.2. Product Portfolio

16.3.10.3. Financial Overview

16.3.10.4. SWOT Analysis

16.3.10.5. Strategic Overview

16.3.11. Merck kGaA

16.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.11.2. Product Portfolio

16.3.11.3. Financial Overview

16.3.11.4. SWOT Analysis

16.3.11.5. Strategic Overview

List of Tables

Table 01: Global Immunoassay Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 02: Global Immunoassay Market Size (US$ Mn) Forecast, by Technology, 2017–2031

Table 03: Global Immunoassay Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 04: Global Immunoassay Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 05: Global Immunoassay Market Size (US$ Mn) Forecast, by Region, 2017–2031

Table 06: North America Immunoassay Market Size (US$ Mn) Forecast, by Country, 2017–2031

Table 07: North America Immunoassay Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 08: North America Immunoassay Market Size (US$ Mn) Forecast, by Technology, 2017–2031

Table 09: North America Immunoassay Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 10: North America Immunoassay Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 11: Europe Immunoassay Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 12: Europe Immunoassay Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 13: Europe Immunoassay Market Size (US$ Mn) Forecast, by Technology, 2017–2031

Table 14: Europe Immunoassay Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 15: Europe Immunoassay Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 16: Asia Pacific Immunoassay Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Asia Pacific Immunoassay Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 18: Asia Pacific Immunoassay Market Size (US$ Mn) Forecast, by Technology, 2017–2031

Table 19: Asia Pacific Immunoassay Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 20: Asia Pacific Immunoassay Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 21: Latin America Immunoassay Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Latin America Immunoassay Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 23: Latin America Immunoassay Market Size (US$ Mn) Forecast, by Technology, 2017–2031

Table 24: Latin America Immunoassay Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 25: Latin America Immunoassay Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 26: Middle East & Africa Immunoassay Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 27: Middle East & Africa Immunoassay Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 28: Middle East & Africa Immunoassay Market Size (US$ Mn) Forecast, by Technology, 2017–2031

Table 29: Middle East & Africa Immunoassay Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 30: Middle East & Africa Immunoassay Market Size (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Immunoassay Market Size (US$ Mn), by Region, 2022 and 2031

Figure 02: Global Immunoassay Market Revenue (US$ Mn), by Product, 2022

Figure 03: Global Immunoassay Market Value Share, by Product, 2022

Figure 04: Global Immunoassay Market Revenue (US$ Mn), by Technology, 2022

Figure 05: Global Immunoassay Market Value Share, by Technology, 2022

Figure 06: Global Immunoassay Market Revenue (US$ Mn), by Application, 2022

Figure 07: Global Immunoassay Market Value Share, by Application, 2022

Figure 08: Global Immunoassay Market Revenue (US$ Mn), by End-user, 2022

Figure 09: Global Immunoassay Market Value Share, by End-user, 2022

Figure 10: Global Immunoassay Market Value Share, by Region, 2022

Figure 11: Global Immunoassay Market Value (US$ Mn) Forecast, 2017–2031

Figure 12: Global Immunoassay Market Value Share Analysis, by Product, 2022 and 2031

Figure 13: Global Immunoassay Market Attractiveness Analysis, by Product, 2023-2031

Figure 14: Global Immunoassay Market Value Share Analysis, by Technology, 2022 and 2031

Figure 15: Global Immunoassay Market Attractiveness Analysis, by Technology, 2023-2031

Figure 16: Global Immunoassay Market Value Share Analysis, by Application, 2022 and 2031

Figure 17: Global Immunoassay Market Attractiveness Analysis, by Application, 2023-2031

Figure 18: Global Immunoassay Market Revenue (US$ Mn), by End-user, 2022

Figure 19: Global Immunoassay Market Value Share, by End-user, 2022

Figure 20: Global Immunoassay Market Value Share Analysis, by Region, 2022 and 2031

Figure 21: Global Immunoassay Market Attractiveness Analysis, by Region, 2023-2031

Figure 22: North America Immunoassay Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 23: North America Immunoassay Market Attractiveness Analysis, by Country, 2023–2031

Figure 24: North America Immunoassay Market Value Share Analysis, by Country, 2022 and 2031

Figure 25: North America Immunoassay Market Value Share Analysis, by Product, 2022 and 2031

Figure 26: North America Immunoassay Market Value Share Analysis, by Technology, 2022 and 2031

Figure 27: North America Immunoassay Market Value Share Analysis, by Application, 2022 and 2031

Figure 28: North America Immunoassay Market Value Share Analysis, by End-user, 2022 and 2031

Figure 29: North America Immunoassay Market Attractiveness Analysis, by Product, 2023–2031

Figure 30: North America Immunoassay Market Attractiveness Analysis, by Technology, 2023–2031

Figure 31: North America Immunoassay Market Attractiveness Analysis, by Application, 2023–2031

Figure 32: North America Immunoassay Market Attractiveness Analysis, by End-user, 2023–2031

Figure 33: Europe Immunoassay Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 34: Europe Immunoassay Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 35: Europe Immunoassay Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 36: Europe Immunoassay Market Value Share Analysis, by Product, 2022 and 2031

Figure 37: Europe Immunoassay Market Value Share Analysis, by Technology, 2022 and 2031

Figure 38: Europe Immunoassay Market Value Share Analysis, by Application, 2022 and 2031

Figure 39: Europe Immunoassay Market Value Share Analysis, by End-user, 2022 and 2031

Figure 40: Europe Immunoassay Market Attractiveness Analysis, by Product, 2023–2031

Figure 41: Europe Immunoassay Market Attractiveness Analysis, by Technology, 2023–2031

Figure 42: Europe Immunoassay Market Attractiveness Analysis, by Application, 2023–2031

Figure 43: Europe Immunoassay Market Attractiveness Analysis, by End-user, 2023–2031

Figure 44: Asia Pacific Immunoassay Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 45: Asia Pacific Immunoassay Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 46: Asia Pacific Immunoassay Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 47: Asia Pacific Immunoassay Market Value Share Analysis, by Product, 2022 and 2031

Figure 48: Asia Pacific Immunoassay Market Value Share Analysis, by Technology, 2022 and 2031

Figure 49: Asia Pacific Immunoassay Market Value Share Analysis, by Application, 2022 and 2031

Figure 50: Asia Pacific Immunoassay Market Value Share Analysis, by End-user, 2022 and 2031

Figure 51: Asia Pacific Immunoassay Market Attractiveness Analysis, by Product, 2023–2031

Figure 52: Asia Pacific Immunoassay Market Attractiveness Analysis, by Technology, 2023–2031

Figure 53: Asia Pacific Immunoassay Market Attractiveness Analysis, by Application, 2023–2031

Figure 54: Asia Pacific Immunoassay Market Attractiveness Analysis, by End-user, 2022–2031

Figure 55: Latin America Immunoassay Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 56: Latin America Immunoassay Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 57: Latin America Immunoassay Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 58: Latin America Immunoassay Market Value Share Analysis, by Product, 2022 and 2031

Figure 59: Latin America Immunoassay Market Value Share Analysis, by Technology, 2022 and 2031

Figure 60: Latin America Immunoassay Market Value Share Analysis, by Application, 2022 and 2031

Figure 61: Latin America Immunoassay Market Value Share Analysis, by End-user, 2022 and 2031

Figure 62: Latin America Immunoassay Market Attractiveness Analysis, by Product, 2023–2031

Figure 63: Latin America Immunoassay Market Attractiveness Analysis, by Technology, 2023–2031

Figure 64: Latin America Immunoassay Market Attractiveness Analysis, by Application, 2023–2031

Figure 65: Latin America Immunoassay Market Attractiveness Analysis, by End-user, 2023–2031

Figure 66: Middle East & Africa Immunoassay Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 67: Middle East & Africa Immunoassay Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 68: Middle East & Africa Immunoassay Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 69: Middle East & Africa Immunoassay Market Value Share Analysis, by Product, 2022 and 2031

Figure 70: Middle East & Africa Immunoassay Market Value Share Analysis, by Technology, 2022 and 2031

Figure 71: Middle East & Africa Immunoassay Market Value Share Analysis, by Application, 2022 and 2031

Figure 72: Middle East & Africa Immunoassay Market Value Share Analysis, by End-user, 2022 and 2031

Figure 73: Middle East & Africa Immunoassay Market Attractiveness Analysis, by Product, 2023–2031

Figure 74: Middle East & Africa Immunoassay Market Attractiveness Analysis, by Technology, 2023–2031

Figure 75: Middle East & Africa Immunoassay Market Attractiveness Analysis, by Application, 2023–2031

Figure 76: Middle East & Africa Immunoassay Market Attractiveness Analysis, by End-user, 2023–2031