Home > Automotive > Automotive Services > Shared Mobility > Mobility on Demand Market

Mobility on Demand Market Size By Service (Car Sharing [By Model {P2P, Station-Based, Free-Floating}, By Business Model {Round Trip, One Way}], Ride Hailing, Car Rental [By Vehicle Type {Luxury Car, Executive Car, Economy Car, SUV, MUV}], By Application (Business, Private), Industry Analysis Report, Regional Outlook, Growth Potential, Competitive Market Share & Forecast, 2019 – 2026

- Report ID: GMI1229

- Published Date: Nov 2019

- Report Format: PDF

Mobility on Demand Market Size

Mobility on Demand Market size valued at USD 110 billion, globally in 2018 and is estimated to grow at over 10% CAGR between 2019 and 2026.

The increasing focus on reduction & control of high air pollution levels due to heavy vehicular traffic is creating the need for alternative transportation forms, driving mobility on demand market value globally. Consumer preferences in North American and European countries are shifting from old vehicular transport to various other mobility choices, leading to the demand for flexible travel options. The mobility on demand industry is witnessing popularity owing to the emphasis on public & private transportation options that allow shared usage & multimodal integration. Additionally, the development of these services allows users to make choices from various available options and offer easy-to-use smartphone applications, resulting in high consumer satisfaction. Rising usage of the technology will contribute to developing a new transport ecosystem with personal mobility needs and innovative technological infrastructure.

| Report Attribute | Details |

|---|---|

| Base Year: | 2018 |

| Mobility on Demand Market Size in 2018: | Over 110 Billion (USD) |

| Forecast Period: | 2019 to 2026 |

| Forecast Period 2019 to 2026 CAGR: | 10% |

| 2026 Value Projection: | Over 250 Billion (USD) |

| Historical Data for: | 2014 to 2018 |

| No. of Pages: | 320 |

| Tables, Charts & Figures: | 585 |

| Segments covered: | Service, Application |

| Growth Drivers: |

|

| Pitfalls & Challenges: |

|

The emergence of Mobility-as-a-Service (MaaS), electric vehicles, and autonomous cars is expected to transform the transportation ecosystem due to more efficient, driverless, and data-driven options, further accelerating the market revenue. A major factor hampering the industry is the unavailability of a robust technical & transportation infrastructure in several small countries. The service providers face huge technical & security challenges due to sudden breakdowns and malfunctioning of smartphone applications, leading to consumer losses. The software infrastructure is easily prone to cyber thefts and hacks, resulting in the loss of valuable data of companies and customers. The development of highly secure software applications and the elimination of technical errors will aid in overcoming these challenges.

Mobility on Demand Market Analysis

Increasing vehicle purchasing and ownership costs due to the launch of technically advanced passenger cars are adding up to the usage of rental cars. Consumers across the globe are opting for these options to save the huge maintenance & ownership costs along with the ability to use the latest car models offered by rental providers. Car rental enables users to travel to remote places that are difficult to access by a bus or taxi. Moreover, owing to the rising competition among car rental companies, they offer customer-oriented deals and a broad range of cars. The surge of the tourism industry in European & Asian countries is also creating a demand for rental cars. These services allow consumers to travel on their own with cheaper options and enhanced features related to payment, pick & drop facilities, etc. In October 2019, Ola announced the launch of its self-drive car rental services in Indian cities including Mumbai, Hyderabad, and New Delhi. The company has planned to add around 20,000 vehicles by 2020 and will allow users to design various rental packages.

Shifting consumer preferences from car ownership to flexible & affordable transportation solutions are propelling the adoption of car-sharing services in the mobility on demand market. Owing to the increased consumer awareness, growing popularity, and the need for shared transportation, global leaders are emerging into untapped regions. With these strategies, global players have financial & technical advantages over the local providers, leading to market consolidation. Additionally, several benefits associated with car-sharing models including low traveling & fuel costs, reduced traffic congestion, and convenience are driving market growth at a rapid pace.

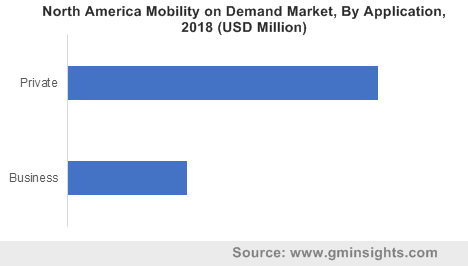

Business organizations and global companies across the globe are focused on providing enhanced transportation & mobility services to their employees. These companies majorly use on-demand mobility services for goods delivery & employee transportation across various metropolitan cities. Several companies have adopted these services to tackle the parking space issues, reducing the amount of air pollution. These services allow companies to reduce carbon emissions, adding up to the environment conservation initiatives along with lesser transportation costs. Corporate car sharing models aid companies to optimize their fleet management & reduce the long-term costs along with providing attractive mobility solutions. Companies can also reduce their administrative costs and the time involved in processing their mileage claims of employees and lower travel allowances.

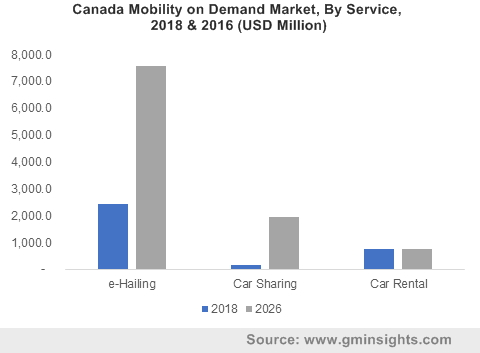

North America mobility on demand industry growth is owing to heavy investments made by major automakers, service providers, and investors. High support from the U.S. government for the promotion & adoption of various on-demand mobility services is adding up to market expansion. For instance, in July 2019, IAC announced an investment of USD 250 million in Turo, a car sharing company. It will use the new investment to enhance the customer experience. In July 2018, General Motors launched its new peer-to-peer car rental program, which will allow owners to rent their vehicles through its online platform. The company has launched this service to aid its customers in earning extra income through their vehicles.

Mobility on Demand Market Share

Prominent players operating in the mobility on demand market include

- Uber Technologies

- Lyft

- Didi Chuxing

- Turo

- Car2Go

- Autolib

- Drivy

- Grab

- Hertz

- Drive Now

These companies and several automakers are involved in new on-demand mobility services in various regions. These strategies are also supported the regional expansion programs to hold leadership in the highly competitive market worldwide. North American and European countries are also experiencing the emergence of several small & locally based car sharing & ride-hailing service providers. For instance, in June 2019, Free2Move, a car-sharing service from Groupe PSA, announced its expansion in Arlington. It will allow the users to pick & park cars in Arlington.

The market comprises several local & global players that offer various types of mobility services. The small & local companies have threats from global players owing to the huge fleet, advanced service packages, and high investment capabilities. The industry participants have threats from new entrants owing to the provision of cheaper mobility options in various regions. Several companies are facing heavy debts and losses owing to the technical problems and fleet issues in the highly competitive industry. Companies are developing flexible mobility solutions to cater to various consumer needs and gain competitive strength.

The Mobility on Demand market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue in USD from 2015 to 2026, for the following segments:

Click here to Buy Section of this Report

By Service

- Ride hailing

- Car sharing

- Model

- P2P

- Station-based

- Free floating

- Business model

- Round trip

- One way

- Model

- Car rental

- Vehicle type

- Luxury car

- Executive car

- Economy car

- SUV

- MUV

- Vehicle type

By Application

- Business

- Private

The above information has been provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Russia

- Spain

- Turkey

- Asia Pacific

- China

- India

- Japan

- Taiwan

- Malaysia

- Singapore

- Australia

- Latin America

- Brazil

- Mexico

- MEA

- GCC

- South Africa