Analysts’ Viewpoint

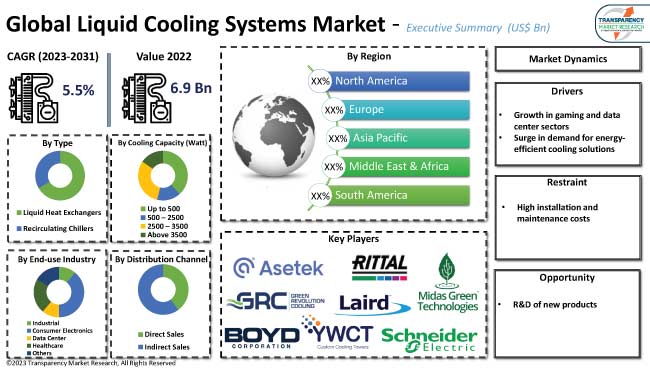

Growth in gaming and data center sectors and surge in demand for energy-efficient cooling solutions are projected to propel the liquid cooling systems market size during the forecast period. Rapid advancements in electronic applications have led to high demand for more complicated and advanced liquid cooling systems.

Future generations of processors are expected to require a lot of energy and produce a lot of heat for running programs that use machine learning, artificial intelligence, and analytics. Thus, various end-use industries are relying heavily on advanced cooling technologies. This is estimated to spur the liquid cooling systems market growth in the near future. Vendors are launching new products with novel technologies to expand their customer base. These technologies include a cold-plate approach, immersion cooling technology, and novel data center fluids.

Liquid cooling system is used to cool electronic or mechanical components, such as computer processors or high-performance graphics cards. The system uses a liquid coolant (usually water or a water-based solution) to dissipate heat. CPUs generate heat and require effective cooling for proper functioning. Liquid cooling systems allow water to circulate through a small pipe within a heat sink connected to the processor.

Liquid cooling is generally employed in personal computers and video game PCs as it allows overclocking of the CPU and GPU while keeping the components cool. As a result, high-power components can be used in extremely compact systems, extending their lifespans.

Liquid cooling systems are becoming increasingly popular in the gaming sector due to their effectiveness in keeping temperatures low and providing a more immersive gaming experience This is especially true for high-end gaming PCs, which require powerful processors and graphics cards to generate intense graphics. Liquid cooling systems help keep these components running at optimal temperatures, allowing for better performance. These systems use a combination of fans and liquid to cool the components of gaming systems, allowing them to run at optimal performance levels. They also allow for more efficient power consumption, making them a cost-effective way to increase gaming performance.

Demand for data centers is increasing in Europe due to rise in global capital investment in major markets such as Frankfurt and London. Frankfurt's greatest obstacle is a lack of sufficient data center capacity, which is being pre-sold in large quantities. There are more than 1,240 server farms in Europe. Rise in data consumption, rapid expansion of data centers, and growth in the gaming sector are anticipated to drive the liquid cooling systems market value during the forecast period.

Increase in energy costs and growth in focus on reducing the environmental impact of cooling systems are boosting the demand for energy-efficient liquid cooling solutions. Liquid cooling solutions are widely seen as an effective way to reduce energy consumption of data centers, industrial processes, and other applications. These systems are typically more efficient than traditional air cooling solutions as they allow for a more even temperature distribution, which leads to improved energy efficiency.

Liquid cooling solutions are often more reliable and require less maintenance than air cooling solutions, which can further reduce energy costs. Data centers are typically highly energy-intensive and cooling solutions are often critical to their long-term performance and reliability. The use of liquid cooling solutions can help reduce the energy consumption of data centers significantly while providing improved performance levels. By reducing the amount of energy used, liquid cooling solutions can aid in mitigating the amount of greenhouse gases emitted into the atmosphere. Hence, surge in energy costs and rise in focus on environmental sustainability are augmenting the liquid cooling systems market progress.

According to the latest liquid cooling systems market forecast, North America is expected to hold largest share from 2023 to 2031. Increase in investment in data centers is fueling the market dynamics of the region. Direct-to-chip and liquid immersion cooling technologies are gaining traction in North America. The significance of edge data centers has surged as a result of the global development of 5G networks, of which the U.S. is one of the early adopters.

The industry in Asia Pacific is projected to grow at a significant pace in the near future. Rise in awareness regarding liquid cooling systems and their advantages, growth in penetration of advanced systems in data centers, and surge in interest in energy-effective products and solutions are propelling the liquid cooling systems market statistics in the region.

The global industry is highly competitive, with the presence of various global and regional liquid cooling system manufacturers. Most companies are investing in the R&D of new products to increase their liquid cooling systems market share.

Air Care System & Solution India Pvt. Ltd., Asetek A/S, Boyd Corporation, Green Revolution Cooling Inc., Laird Thermal Systems, Lumivida, Midas Green Technologies LLC, Rittal GmbH and Co. Kg, Schneider Electric SE, and YWCT are prominent entities operating in this liquid cooling systems market.

| Attribute | Detail |

|---|---|

| Market Value in 2022 | US$ 6.9 Bn |

| Market Forecast Value in 2031 | US$ 10.9 Bn |

| Growth Rate (CAGR) | 5.5% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2022 |

| Quantitative Units | US$ Bn for Value and Thousand Units for Volume |

| Market Analysis | It includes cross-segment analysis at the regional as well as country level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Region Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 6.9 Bn in 2022

It is projected to grow at a CAGR of 5.5% from 2023 to 2031

Growth in gaming and data center sectors and surge in demand for energy-efficient cooling solutions

North America is projected to hold largest share from 2023 to 2031 during the forecast period

Air Care System & Solution India Pvt. Ltd., Asetek A/S, Boyd Corporation, Green Revolution Cooling Inc., Laird Thermal Systems, Lumivida, Midas Green Technologies LLC, Rittal GmbH and Co. Kg, Schneider Electric SE, and YWCT

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.5. Technological Overview Analysis

5.6. Porter’s Five Forces Analysis

5.7. Industry SWOT Analysis

5.8. Value Chain Analysis

5.9. Regulatory Framework

5.10. Global Liquid Cooling Systems Market Analysis and Forecast, 2017 - 2031

5.10.1. Market Value Projection (US$ Bn)

5.10.2. Market Volume Projection (Thousand Units)

6. Global Liquid Cooling Systems Market Analysis and Forecast, By Type

6.1. Liquid Cooling Systems Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 – 2031

6.1.1. Liquid Heat Exchangers

6.1.1.1. Water-based Heat Exchangers

6.1.1.2. Oil-based Heat Exchangers

6.1.2. Recirculating Chillers

6.1.2.1. Compressor-based

6.1.2.2. Thermoelectric-based

6.2. Incremental Opportunity, By Type

7. Global Liquid Cooling Systems Market Analysis and Forecast, By Cooling Capacity (Watt)

7.1. Liquid Cooling Systems Market Size (US$ Bn and Thousand Units) Forecast, Cooling Capacity (Watt), 2017 - 2031

7.1.1. Up to 500

7.1.2. 500 – 2500

7.1.3. 2500 – 3500

7.1.4. Above 3500

7.2. Incremental Opportunity, By Cooling Capacity (Watt)

8. Global Liquid Cooling Systems Market Analysis and Forecast, By End-use Industry

8.1. Liquid Cooling Systems Market Size (US$ Bn and Thousand Units) Forecast, End-use Industry, 2017 - 2031

8.1.1. Industrial

8.1.2. Consumer Electronics

8.1.3. Data Center

8.1.4. Healthcare

8.1.5. Others (Telecommunications, Analytical Equipment, etc.)

8.2. Incremental Opportunity, By End-use Industry

9. Global Liquid Cooling Systems Market Analysis and Forecast, By Distribution Channel

9.1. Liquid Cooling Systems Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

9.1.1. Direct Sales

9.1.2. Indirect Sales

9.2. Incremental Opportunity, By Distribution Channel

10. Global Liquid Cooling Systems Market Analysis and Forecast, By Region

10.1. Liquid Cooling Systems Market Size (US$ Bn and Thousand Units) Forecast, By Region, 2017 - 2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Incremental Opportunity, By Region

11. North America Liquid Cooling Systems Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Brand Analysis

11.3. Price Trend Analysis

11.3.1. Weighted Average Price

11.4. Key Trends Analysis

11.4.1. Demand Side

11.4.2. Supplier Side

11.5. Liquid Cooling Systems Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 – 2031

11.5.1. Liquid Heat Exchangers

11.5.1.1. Water-based Heat Exchangers

11.5.1.2. Oil-based Heat Exchangers

11.5.2. Recirculating Chillers

11.5.2.1. Compressor-based

11.5.2.2. Thermoelectric-based

11.6. Liquid Cooling Systems Market Size (US$ Bn and Thousand Units) Forecast, Cooling Capacity (Watt), 2017 - 2031

11.6.1. Up to 500

11.6.2. 500 – 2500

11.6.3. 2500 – 3500

11.6.4. Above 3500

11.7. Liquid Cooling Systems Market Size (US$ Bn and Thousand Units) Forecast, End-use Industry, 2017 - 2031

11.7.1. Industrial

11.7.2. Consumer Electronics

11.7.3. Data Center

11.7.4. Healthcare

11.7.5. Others (Telecommunications, Analytical Equipment, etc.)

11.8. Liquid Cooling Systems Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

11.8.1. Direct Sales

11.8.2. Indirect Sales

11.9. Liquid Cooling Systems Market Size (US$ Bn and Thousand Units) Forecast, By Country, 2017 - 2031

11.9.1. U.S.

11.9.2. Canada

11.9.3. Rest of North America

11.10. Incremental Opportunity Analysis

12. Europe Liquid Cooling Systems Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Brand Analysis

12.3. Price Trend Analysis

12.3.1. Weighted Average Price

12.4. Key Trends Analysis

12.4.1. Demand Side

12.4.2. Supplier Side

12.5. Liquid Cooling Systems Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 – 2031

12.5.1. Liquid Heat Exchangers

12.5.1.1. Water-based Heat Exchangers

12.5.1.2. Oil-based Heat Exchangers

12.5.2. Recirculating Chillers

12.5.2.1. Compressor-based

12.5.2.2. Thermoelectric-based

12.6. Liquid Cooling Systems Market Size (US$ Bn and Thousand Units) Forecast, Cooling Capacity (Watt), 2017 - 2031

12.6.1. Up to 500

12.6.2. 500 – 2500

12.6.3. 2500 – 3500

12.6.4. Above 3500

12.7. Liquid Cooling Systems Market Size (US$ Bn and Thousand Units) Forecast, End-use Industry, 2017 - 2031

12.7.1. Industrial

12.7.2. Consumer Electronics

12.7.3. Data Center

12.7.4. Healthcare

12.7.5. Others (Telecommunications, Analytical Equipment, etc.)

12.8. Liquid Cooling Systems Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

12.8.1. Direct Sales

12.8.2. Indirect Sales

12.9. Liquid Cooling Systems Market Size (US$ Bn and Thousand Units) Forecast, By Country, 2017 - 2031

12.9.1. U.K.

12.9.2. Germany

12.9.3. France

12.9.4. Rest of Europe

12.10. Incremental Opportunity Analysis

13. Asia Pacific Liquid Cooling Systems Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Brand Analysis

13.3. Key Trends Analysis

13.3.1. Demand Side

13.3.2. Supplier Side

13.4. Liquid Cooling Systems Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 – 2031

13.4.1. Liquid Heat Exchangers

13.4.1.1. Water-based Heat Exchangers

13.4.1.2. Oil-based Heat Exchangers

13.4.2. Recirculating Chillers

13.4.2.1. Compressor-based

13.4.2.2. Thermoelectric-based

13.5. Liquid Cooling Systems Market Size (US$ Bn and Thousand Units) Forecast, Cooling Capacity (Watt), 2017 - 2031

13.5.1. Up to 500

13.5.2. 500 – 2500

13.5.3. 2500 – 3500

13.5.4. Above 3500

13.6. Liquid Cooling Systems Market Size (US$ Bn and Thousand Units) Forecast, End-use Industry, 2017 - 2031

13.6.1. Industrial

13.6.2. Consumer Electronics

13.6.3. Data Center

13.6.4. Healthcare

13.6.5. Others (Telecommunications, Analytical Equipment, etc.)

13.7. Liquid Cooling Systems Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

13.7.1. Direct Sales

13.7.2. Indirect Sales

13.8. Liquid Cooling Systems Market Size (US$ Bn and Thousand Units) Forecast, By Country, 2017 - 2031

13.8.1. India

13.8.2. China

13.8.3. Japan

13.8.4. Rest of Asia Pacific

13.9. Incremental Opportunity Analysis

14. Middle East & South Africa Liquid Cooling Systems Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Brand Analysis

14.3. Price Trend Analysis

14.3.1. Weighted Average Price

14.4. Key Trends Analysis

14.4.1. Demand Side

14.4.2. Supplier Side

14.5. Liquid Cooling Systems Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 – 2031

14.5.1. Liquid Heat Exchangers

14.5.1.1. Water-based Heat Exchangers

14.5.1.2. Oil-based Heat Exchangers

14.5.2. Recirculating Chillers

14.5.2.1. Compressor-based

14.5.2.2. Thermoelectric-based

14.6. Liquid Cooling Systems Market Size (US$ Bn and Thousand Units) Forecast, Cooling Capacity (Watt), 2017 - 2031

14.6.1. Up to 500

14.6.2. 500 – 2500

14.6.3. 2500 – 3500

14.6.4. Above 3500

14.7. Liquid Cooling Systems Market Size (US$ Bn and Thousand Units) Forecast, End-use Industry, 2017 - 2031

14.7.1. Industrial

14.7.2. Consumer Electronics

14.7.3. Data Center

14.7.4. Healthcare

14.7.5. Others (Telecommunications, Analytical Equipment, etc.)

14.8. Liquid Cooling Systems Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

14.8.1. Direct Sales

14.8.2. Indirect Sales

14.9. Liquid Cooling Systems Market Size (US$ Bn and Thousand Units) Forecast, By Country, 2017 - 2031

14.9.1. GCC

14.9.2. Rest of Middle East & Africa

14.10. Incremental Opportunity Analysis

15. South America Liquid Cooling Systems Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Brand Analysis

15.3. Price Trend Analysis

15.3.1. Weighted Average Price

15.4. Key Trends Analysis

15.4.1. Demand Side

15.4.2. Supplier Side

15.5. Liquid Cooling Systems Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 – 2031

15.5.1. Liquid Heat Exchangers

15.5.1.1. Water-based Heat Exchangers

15.5.1.2. Oil-based Heat Exchangers

15.5.2. Recirculating Chillers

15.5.2.1. Compressor-based

15.5.2.2. Thermoelectric-based

15.6. Liquid Cooling Systems Market Size (US$ Bn and Thousand Units) Forecast, Cooling Capacity (Watt), 2017 - 2031

15.6.1. Up to 500

15.6.2. 500 – 2500

15.6.3. 2500 – 3500

15.6.4. Above 3500

15.7. Liquid Cooling Systems Market Size (US$ Bn and Thousand Units) Forecast, End-use Industry, 2017 - 2031

15.7.1. Industrial

15.7.2. Consumer Electronics

15.7.3. Data Center

15.7.4. Healthcare

15.7.5. Others (Telecommunications, Analytical Equipment, etc.)

15.8. Liquid Cooling Systems Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

15.8.1. Direct Sales

15.8.2. Indirect Sales

15.9. Liquid Cooling Systems Market Size (US$ Bn and Thousand Units) Forecast, By Country, 2017 - 2031

15.9.1. Brazil

15.9.2. Rest of South America

15.10. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Market Player – Competition Dashboard

16.2. Market Share Analysis (%), by Company, (2022)

16.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

16.3.1. Air Care System & Solution India Pvt. Ltd.

16.3.1.1. Company Overview

16.3.1.2. Sales Area/Geographical Presence

16.3.1.3. Revenue

16.3.1.4. Strategy & Business Overview

16.3.2. Asetek A/S

16.3.2.1. Company Overview

16.3.2.2. Sales Area/Geographical Presence

16.3.2.3. Revenue

16.3.2.4. Strategy & Business Overview

16.3.3. Boyd Corporation

16.3.3.1. Company Overview

16.3.3.2. Sales Area/Geographical Presence

16.3.3.3. Revenue

16.3.3.4. Strategy & Business Overview

16.3.4. Green Revolution Cooling Inc.

16.3.4.1. Company Overview

16.3.4.2. Sales Area/Geographical Presence

16.3.4.3. Revenue

16.3.4.4. Strategy & Business Overview

16.3.5. Laird Thermal Systems

16.3.5.1. Company Overview

16.3.5.2. Sales Area/Geographical Presence

16.3.5.3. Revenue

16.3.5.4. Strategy & Business Overview

16.3.6. Lumivida

16.3.6.1. Company Overview

16.3.6.2. Sales Area/Geographical Presence

16.3.6.3. Revenue

16.3.6.4. Strategy & Business Overview

16.3.7. Midas Green Technologies LLC

16.3.7.1. Company Overview

16.3.7.2. Sales Area/Geographical Presence

16.3.7.3. Revenue

16.3.7.4. Strategy & Business Overview

16.3.8. Rittal GmbH and Co. Kg

16.3.8.1. Company Overview

16.3.8.2. Sales Area/Geographical Presence

16.3.8.3. Revenue

16.3.8.4. Strategy & Business Overview

16.3.9. Schneider Electric SE

16.3.9.1. Company Overview

16.3.9.2. Sales Area/Geographical Presence

16.3.9.3. Revenue

16.3.9.4. Strategy & Business Overview

16.3.10. YWCT

16.3.10.1. Company Overview

16.3.10.2. Sales Area/Geographical Presence

16.3.10.3. Revenue

16.3.10.4. Strategy & Business Overview

16.3.11. Other Key Players

16.3.11.1. Company Overview

16.3.11.2. Sales Area/Geographical Presence

16.3.11.3. Revenue

16.3.11.4. Strategy & Business Overview

17. Go to Market Strategy

17.1. Identification of Potential Market Spaces

17.1.1. By Type

17.1.2. By Cooling Capacity (Watts)

17.1.3. By End-use Industry

17.1.4. By Distribution Channel

17.1.5. By Region

17.2. Prevailing Market Risks

17.3. Understanding Buying Process of Customers

17.4. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Liquid Cooling Systems Market Value (US$ Bn), by Type, 2017-2031

Table 2: Global Liquid Cooling Systems Market Volume (Thousand Units), by Type 2017-2031

Table 3: Global Liquid Cooling Systems Market Value (US$ Bn), by Cooling Capacity (Watts), 2017-2031

Table 4: Global Liquid Cooling Systems Market Volume (Thousand Units), by Cooling Capacity (Watts) 2017-2031

Table 5: Global Liquid Cooling Systems Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 6: Global Liquid Cooling Systems Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 7: Global Liquid Cooling Systems Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 8: Global Liquid Cooling Systems Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 9: Global Liquid Cooling Systems Market Value (US$ Bn), by Region, 2017-2031

Table 10: Global Liquid Cooling Systems Market Volume (Thousand Units), by Region 2017-2031

Table 11: North America Liquid Cooling Systems Market Value (US$ Bn), by Type, 2017-2031

Table 12: North America Liquid Cooling Systems Market Volume (Thousand Units), by Type 2017-2031

Table 13: North America Liquid Cooling Systems Market Value (US$ Bn), by Cooling Capacity (Watts), 2017-2031

Table 14: North America Liquid Cooling Systems Market Volume (Thousand Units), by Cooling Capacity (Watts) 2017-2031

Table 15: North America Liquid Cooling Systems Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 16: North America Liquid Cooling Systems Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 17: North America Liquid Cooling Systems Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 18: North America Liquid Cooling Systems Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 19: North America Liquid Cooling Systems Market Value (US$ Bn), by Region, 2017-2031

Table 20: North America Liquid Cooling Systems Market Volume (Thousand Units), by Region 2017-2031

Table 21: Europe Liquid Cooling Systems Market Value (US$ Bn), by Type, 2017-2031

Table 22: Europe Liquid Cooling Systems Market Volume (Thousand Units), by Type 2017-2031

Table 23: Europe Liquid Cooling Systems Market Value (US$ Bn), by Cooling Capacity (Watts), 2017-2031

Table 24: Europe Liquid Cooling Systems Market Volume (Thousand Units), by Cooling Capacity (Watts) 2017-2031

Table 25: Europe Liquid Cooling Systems Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 26: Europe Liquid Cooling Systems Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 27: Europe Liquid Cooling Systems Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 28: Europe Liquid Cooling Systems Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 29: Europe Liquid Cooling Systems Market Value (US$ Bn), by Region, 2017-2031

Table 30: Europe Liquid Cooling Systems Market Volume (Thousand Units), by Region 2017-2031

Table 31: Asia Pacific Liquid Cooling Systems Market Value (US$ Bn), by Type, 2017-2031

Table 32: Asia Pacific Liquid Cooling Systems Market Volume (Thousand Units), by Type 2017-2031

Table 33: Asia Pacific Liquid Cooling Systems Market Value (US$ Bn), by Cooling Capacity (Watts), 2017-2031

Table 34: Asia Pacific Liquid Cooling Systems Market Volume (Thousand Units), by Cooling Capacity (Watts) 2017-2031

Table 35: Asia Pacific Liquid Cooling Systems Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 36: Asia Pacific Liquid Cooling Systems Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 37: Asia Pacific Liquid Cooling Systems Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 38: Asia Pacific Liquid Cooling Systems Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 39: Asia Pacific Liquid Cooling Systems Market Value (US$ Bn), by Region, 2017-2031

Table 40: Asia Pacific Liquid Cooling Systems Market Volume (Thousand Units), by Region 2017-2031

Table 41: Middle East & Africa Liquid Cooling Systems Market Value (US$ Bn), by Type, 2017-2031

Table 42: Middle East & Africa Liquid Cooling Systems Market Volume (Thousand Units), by Type 2017-2031

Table 43: Middle East & Africa Liquid Cooling Systems Market Value (US$ Bn), by Cooling Capacity (Watts), 2017-2031

Table 44: Middle East & Africa Liquid Cooling Systems Market Volume (Thousand Units), by Cooling Capacity (Watts) 2017-2031

Table 45: Middle East & Africa Liquid Cooling Systems Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 46: Middle East & Africa Liquid Cooling Systems Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 47: Middle East & Africa Liquid Cooling Systems Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 48: Middle East & Africa Liquid Cooling Systems Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 49: Middle East & Africa Liquid Cooling Systems Market Value (US$ Bn), by Region, 2017-2031

Table 50: Middle East & Africa Liquid Cooling Systems Market Volume (Thousand Units), by Region 2017-2031

Table 51: South America Liquid Cooling Systems Market Value (US$ Bn), by Type, 2017-2031

Table 52: South America Liquid Cooling Systems Market Volume (Thousand Units), by Type 2017-2031

Table 53: South America Liquid Cooling Systems Market Value (US$ Bn), by Cooling Capacity (Watts), 2017-2031

Table 54: South America Liquid Cooling Systems Market Volume (Thousand Units), by Cooling Capacity (Watts) 2017-2031

Table 55: South America Liquid Cooling Systems Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 56: South America Liquid Cooling Systems Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 57: South America Liquid Cooling Systems Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 58: South America Liquid Cooling Systems Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 59: South America Liquid Cooling Systems Market Value (US$ Bn), by Region, 2017-2031

Table 60: South America Liquid Cooling Systems Market Volume (Thousand Units), by Region 2017-2031

List of Figures

Figure 1: Global Liquid Cooling Systems Market Value (US$ Bn), by Type, 2017-2031

Figure 2: Global Liquid Cooling Systems Market Volume (Thousand Units), by Type 2017-2031

Figure 3: Global Liquid Cooling Systems Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 4: Global Liquid Cooling Systems Market Value (US$ Bn), by Cooling Capacity (Watts), 2017-2031

Figure 5: Global Liquid Cooling Systems Market Volume (Thousand Units), by Cooling Capacity (Watts) 2017-2031

Figure 6: Global Liquid Cooling Systems Market Incremental Opportunity (US$ Bn), Forecast, by Cooling Capacity (Watts), 2023-2031

Figure 7: Global Liquid Cooling Systems Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 8: Global Liquid Cooling Systems Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 9: Global Liquid Cooling Systems Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 10: Global Liquid Cooling Systems Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 11: Global Liquid Cooling Systems Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 12: Global Liquid Cooling Systems Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 13: Global Liquid Cooling Systems Market Value (US$ Bn), by Region, 2017-2031

Figure 14: Global Liquid Cooling Systems Market Volume (Thousand Units), by Region 2017-2031

Figure 15: Global Liquid Cooling Systems Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 16: North America Liquid Cooling Systems Market Value (US$ Bn), by Type, 2017-2031

Figure 17: North America Liquid Cooling Systems Market Volume (Thousand Units), by Type 2017-2031

Figure 18: North America Liquid Cooling Systems Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 19: North America Liquid Cooling Systems Market Value (US$ Bn), by Cooling Capacity (Watts), 2017-2031

Figure 20: North America Liquid Cooling Systems Market Volume (Thousand Units), by Cooling Capacity (Watts) 2017-2031

Figure 21: North America Liquid Cooling Systems Market Incremental Opportunity (US$ Bn), Forecast, by Cooling Capacity (Watts), 2023-2031

Figure 22: North America Liquid Cooling Systems Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 23: North America Liquid Cooling Systems Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 24: North America Liquid Cooling Systems Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 25: North America Liquid Cooling Systems Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 26: North America Liquid Cooling Systems Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 27: North America Liquid Cooling Systems Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 28: North America Liquid Cooling Systems Market Value (US$ Bn), by Region, 2017-2031

Figure 29: North America Liquid Cooling Systems Market Volume (Thousand Units), by Region 2017-2031

Figure 30: North America Liquid Cooling Systems Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 31: Europe Liquid Cooling Systems Market Value (US$ Bn), by Type, 2017-2031

Figure 32: Europe Liquid Cooling Systems Market Volume (Thousand Units), by Type 2017-2031

Figure 33: Europe Liquid Cooling Systems Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 34: Europe Liquid Cooling Systems Market Value (US$ Bn), by Cooling Capacity (Watts), 2017-2031

Figure 35: Europe Liquid Cooling Systems Market Volume (Thousand Units), by Cooling Capacity (Watts) 2017-2031

Figure 36: Europe Liquid Cooling Systems Market Incremental Opportunity (US$ Bn), Forecast, by Cooling Capacity (Watts), 2023-2031

Figure 37: Europe Liquid Cooling Systems Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 38: Europe Liquid Cooling Systems Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 39: Europe Liquid Cooling Systems Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 40: Europe Liquid Cooling Systems Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 41: Europe Liquid Cooling Systems Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 42: Europe Liquid Cooling Systems Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 43: Europe Liquid Cooling Systems Market Value (US$ Bn), by Region, 2017-2031

Figure 44: Europe Liquid Cooling Systems Market Volume (Thousand Units), by Region 2017-2031

Figure 45: Europe Liquid Cooling Systems Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 46: Asia Pacific Liquid Cooling Systems Market Value (US$ Bn), by Type, 2017-2031

Figure 47: Asia Pacific Liquid Cooling Systems Market Volume (Thousand Units), by Type 2017-2031

Figure 48: Asia Pacific Liquid Cooling Systems Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 49: Asia Pacific Liquid Cooling Systems Market Value (US$ Bn), by Cooling Capacity (Watts), 2017-2031

Figure 50: Asia Pacific Liquid Cooling Systems Market Volume (Thousand Units), by Cooling Capacity (Watts) 2017-2031

Figure 51: Asia Pacific Liquid Cooling Systems Market Incremental Opportunity (US$ Bn), Forecast, by Cooling Capacity (Watts), 2023-2031

Figure 52: Asia Pacific Liquid Cooling Systems Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 53: Asia Pacific Liquid Cooling Systems Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 54: Asia Pacific Liquid Cooling Systems Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 55: Asia Pacific Liquid Cooling Systems Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 56: Asia Pacific Liquid Cooling Systems Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 57: Asia Pacific Liquid Cooling Systems Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 58: Asia Pacific Liquid Cooling Systems Market Value (US$ Bn), by Region, 2017-2031

Figure 59: Asia Pacific Liquid Cooling Systems Market Volume (Thousand Units), by Region 2017-2031

Figure 60: Asia Pacific Liquid Cooling Systems Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 61: Middle East & Africa Liquid Cooling Systems Market Value (US$ Bn), by Type, 2017-2031

Figure 62: Middle East & Africa Liquid Cooling Systems Market Volume (Thousand Units), by Type 2017-2031

Figure 63: Middle East & Africa Liquid Cooling Systems Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 64: Middle East & Africa Liquid Cooling Systems Market Value (US$ Bn), by Cooling Capacity (Watts), 2017-2031

Figure 65: Middle East & Africa Liquid Cooling Systems Market Volume (Thousand Units), by Cooling Capacity (Watts) 2017-2031

Figure 66: Middle East & Africa Liquid Cooling Systems Market Incremental Opportunity (US$ Bn), Forecast, by Cooling Capacity (Watts), 2023-2031

Figure 67: Middle East & Africa Liquid Cooling Systems Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 68: Middle East & Africa Liquid Cooling Systems Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 69: Middle East & Africa Liquid Cooling Systems Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2017-2031

Figure 70: Middle East & Africa Liquid Cooling Systems Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 71: Middle East & Africa Liquid Cooling Systems Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 72: Middle East & Africa Liquid Cooling Systems Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 73: Middle East & Africa Liquid Cooling Systems Market Value (US$ Bn), by Region, 2017-2031

Figure 74: Middle East & Africa Liquid Cooling Systems Market Volume (Thousand Units), by Region 2017-2031

Figure 75: Middle East & Africa Liquid Cooling Systems Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 76: South America Liquid Cooling Systems Market Value (US$ Bn), by Type, 2017-2031

Figure 77: South America Liquid Cooling Systems Market Volume (Thousand Units), by Type 2017-2031

Figure 78: South America Liquid Cooling Systems Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 79: South America Liquid Cooling Systems Market Value (US$ Bn), by Cooling Capacity (Watts), 2017-2031

Figure 80: South America Liquid Cooling Systems Market Volume (Thousand Units), by Cooling Capacity (Watts) 2017-2031

Figure 81: South America Liquid Cooling Systems Market Incremental Opportunity (US$ Bn), Forecast, by Cooling Capacity (Watts), 2023-2031

Figure 82: South America Liquid Cooling Systems Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 83: South America Liquid Cooling Systems Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 84: South America Liquid Cooling Systems Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 85: South America Liquid Cooling Systems Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 86: South America Liquid Cooling Systems Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 87: South America Liquid Cooling Systems Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 88: South America Liquid Cooling Systems Market Value (US$ Bn), by Region, 2017-2031

Figure 89: South America Liquid Cooling Systems Market Volume (Thousand Units), by Region 2017-2031

Figure 90: South America Liquid Cooling Systems Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031