Hemostats Market by Type (Thrombin, Oxidized Regenerated Cellulose, Combination, Gelatin, Collagen), Formulation (Matrix & Gel, Sheet & Pad, Sponge, Powder), Application (Orthopedic, Neurological, Cardiovascular Surgery), Region - Global Forecast to 2028

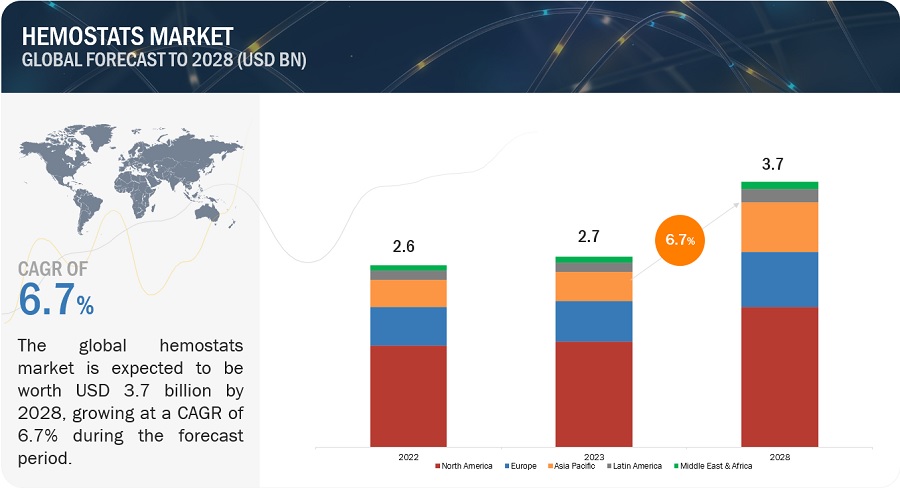

The global hemostats market in terms of revenue was estimated to be worth $2.7 billion in 2023 and is poised to reach $3.7 billion by 2028, growing at a CAGR of 6.7% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. Globally, the growing number of accidents has increased the number of surgeries that involve long operating hours. One of the major reasons for blood loss in surgery and trauma patients is the ineffective use of traditional wound closure products, such as sutures, staples, and other hemostatic agents. This, in turn, has increased the need for effective blood loss management products such as hemostats during surgical procedure.

Attractive Opportunities in the Hemostats Market

To know about the assumptions considered for the study, Request for Free Sample Report

Hemostats Market Dynamics

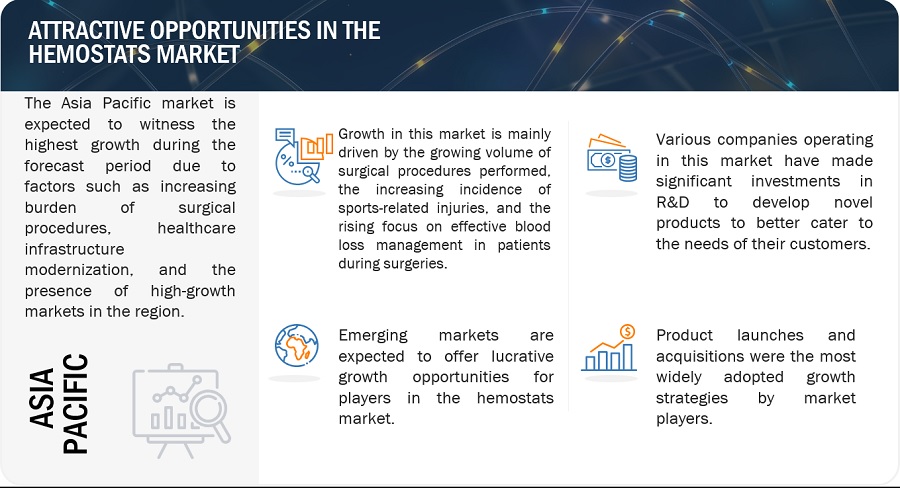

DRIVER: Growing volume of surgical procedures performed

Common age-related diseases and conditions include arthritis, osteoporosis, lumbar spinal stenosis (LSS), gastroesophageal reflux disease (GERD), and benign prostatic hyperplasia (BPH). These conditions often necessitate surgery to alleviate pain and improve joint function. Patients with arthritis and osteoporosis may have weakened bones and fragile blood vessels, increasing the risk of intraoperative bleeding during knee replacement surgery. Hemostatic agents are crucial in controlling bleeding effectively to prevent complications like hematoma formation and prolonged surgery times.

RESTRAINT: Side effects and allergic reactions associated with hemostats

Poor-quality products are the primary cause of side effects and allergic reactions associated with hemostats. Poor-quality products cause infections, which not only increase the recovery time and, in some cases, may even result in death. Excessive fibrosis and prolonged fixation of a tendon have been reported when absorbable gelatin-based sponges were used in severed tendon repair. Poor-quality products can have a negative impact on the end-user perception of the safety of hemostats and, in turn, affect their adoption in treatment procedures, which also increases the need for alternative products.

OPPORTUNITY: Growth opportunities in emerging economies

Emerging countries across the Asia Pacific, Latin America, and the Middle East & Africa offer significant growth opportunities to major market players operating in the market. This can be attributed to the healthcare infrastructural improvements in these countries, the growing patient population, and the rising healthcare expenditure.

Moreover, the disposable income of populations in developing and emerging countries is on the rise. This increase is another key indicator of expanding access to healthcare. With rising disposable incomes and the increasing medical needs of the middle-class population, hemostats manufacturers are compelled to devise new strategies to meet this demand. Currently, emerging markets are underpenetrated by major players, which indicates a huge untapped market potential.

CHALLENGE: Dearth of skilled personnel for effective use of hemostats

Skilled professionals are required to handle hemostats as the improper closure of arteries after surgical procedures may lead to continuous bleeding or cause ischemia. Some devices even require several steps in sequence while using them. Currently, the lack of skilled surgeons, both in developed and developing economies, is one of the major factors limiting the adoption of these products. The technology landscape and application areas of hemostats are changing rapidly, owing to technological advancements in this field. This necessitates physicians and other healthcare providers to acquire the necessary skills to apply advanced hemostats.

Hemostats Ecosystem/Market Map

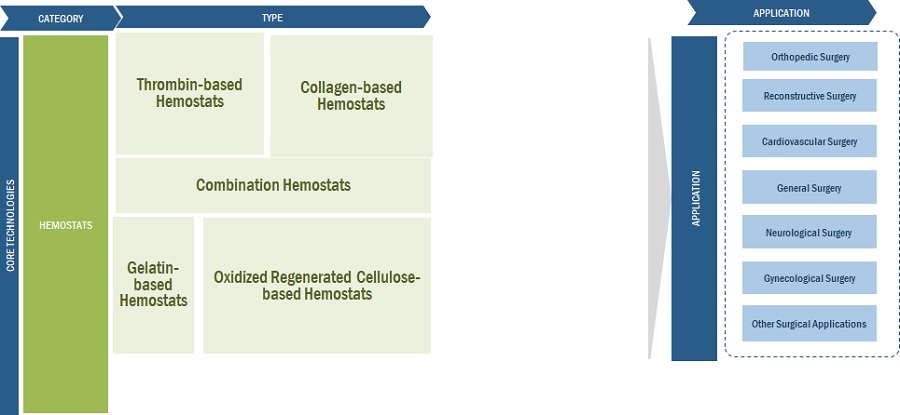

Oxidized regenerated cellulose-based hemostats segment accounted for the largest share of the hemostats industry in 2022, by type.

The hemostats market is categorized into oxidized regenerated cellulose-based hemostats, thrombin-based hemostats, combination hemostats, gelatin-based hemostats, collagen-based hemostats, and other hemostats, based on type. The oxidized regenerated cellulose-based hemostats segment emerged as the dominant force in the market in 2022. Biocompatibility is a critical consideration in medical products, and ORC-based hemostatic agents are known for their excellent safety profile. ORC-based products are biocompatible, which means they are well-tolerated by the body and typically do not cause adverse reactions or tissue irritation. This quality is crucial in surgical applications, where patient safety is paramount.

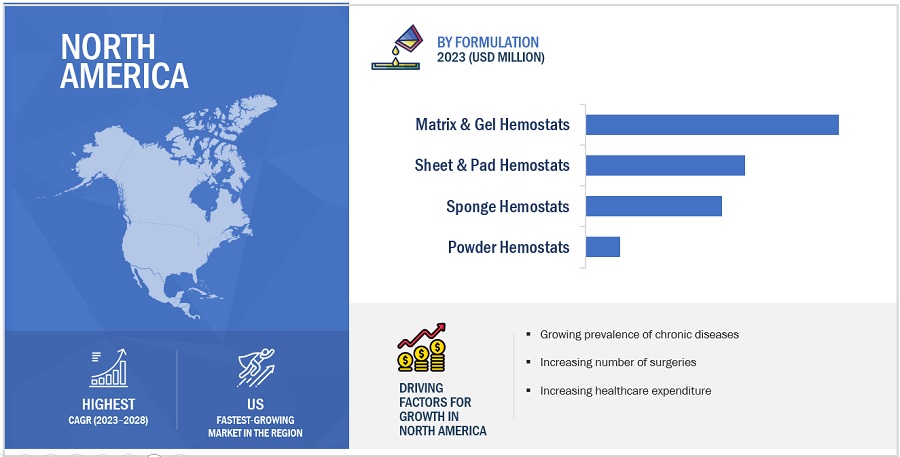

Matrix & gel hemostats segment accounted for the largest share in the hemostats industry in 2022, by formulation.

The global hemostats market is categorized into matrix & gel hemostats, sheet & pad hemostats, sponge hemostats, and powder hemostats based on formulation. In 2022, the matrix & gel hemostats segment held the largest share in the market. The substantial market share of matrix & gel hemostats segment can be attributed to the advantages offered by these hemostats, such as their user-friendly application, their economical nature, and biocompatibility.

Orthopedic surgery segment accounted for the largest share in the hemostats industry in 2022, by application.

The hemostats market has been segmented into orthopedic surgery, general surgery, neurological surgery, cardiovascular surgery, thoracic surgery, gynecological surgery, reconstructive surgery, and other surgical applications, based on application. In 2022, the orthopedic surgery segment accounted for the largest share of the market. The growing prevalence of lifestyle disorders, such as arthritis, osteoporosis, and obesity (leading to orthopedic problems), is a major factor responsible for the growing number of orthopedic surgeries performed globally. The increasing geriatric population further contributes to the increased incidence of target disorders globally. The increasing incidence of sports injuries further supports the uptake of hemostats.

North America accounted for the largest share of the hemostats industry in 2022.

The hemostats market is segmented into five major regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. In 2022, North America emerged as the leading contributor, claiming the largest portion of the market share in the hemostats industry. The region has a robust infrastructure for R&D. Also, North America houses several major companies operating in the hemostats sector. These companies have significant expertise, resources, and established distribution networks, which contribute to the region's market dominance. Also, the high burden of chronic conditions on regional healthcare systems is another major driver for market growth. In line with this, the growing volume of orthopedic, bariatric, hernia repair, cardiothoracic, and neurological surgical procedures performed in the region has resulted in the increased demand for hemostats.

To know about the assumptions considered for the study, download the pdf brochure

The major players in this market are Johnson (US), Baxter International (US), Pfizer Inc. (US), B. Braun SE (Germany), and Becton, Dickinson and Company (US). The market leadership of these players stems from their comprehensive product portfolios and expansive global footprint. These dominant market players possess several advantages, including strong marketing and distribution networks, substantial research and development budgets, and well-established brand recognition.

Scope of the Hemostats Industry:

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$2.7 billion |

|

Estimated Value by 2028 |

$3.7 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 6.7% |

|

Market Driver |

Growing volume of surgical procedures performed |

|

Market Opportunity |

Growth opportunities in emerging economies |

This report categorizes the hemostats market to forecast revenue and analyze trends in each of the following submarkets:

By Type

- Thrombin-based Hemostats

- Oxidized Regenerated Cellulose-based Hemostats

- Combination Hemostats

- Gelatin-based Hemostats

- Collagen-based Hemostats

- Other Hemostats

By Formulation

- Matrix & Gel Hemostats

- Sheet & Pad Hemostats

- Sponge Hemostats

- Powder Hemostats

By Application

- Orthopedic Surgery

- General Surgery

- Neurological Surgery

- Cardiovascular Surgery

- Reconstructive Surgery

- Gynecological Surgery

- Other Surgical Applications

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Switzerland

- Belgium

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia

- Singapore

- New Zealand

- South Korea

- Indonesia

- Malaysia

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

Recent Developments of Hemostats Industry

- In August 2023, Teleflex Incorporated (US) received US FDA clearance for the expanded indication for QuikClot Control+ in cardiac surgical procedures.

- In July 2023, Baxter International (US) launched its PERCLOT Absorbable Hemostatic Powder in the US. This will allow the company to provide surgeons with a full range of active and passive hemostatic products for bleeding control, helping to optimize care for patients.

- In December 2020, Teleflex (US) acquired Z-Medica, LLC (US), a medical device company that manufactures and sells hemostatic (hemorrhage control) products.

- In March 2020, Ethicon announced the strategic regional launch of the SURGICEL Powder Absorbable Hemostat in Australia, New Zealand, and Thailand.

- In December 2019, Advanced Medical Solutions Group (UK) acquired Biomatlante (France), a well-established international developer and manufacturer of innovative surgical biomaterial technologies.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global hemostats market?

The global hemostats market boasts a total revenue value of $3.7 billion by 2028.

What is the estimated growth rate (CAGR) of the global hemostats market?

The global hemostats market has an estimated compound annual growth rate (CAGR) of 6.7% and a revenue size in the region of $2.7 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The objective of the study is to analyze the key market dynamics, such as drivers, opportunities, restraints, challenges, and key player strategies. To track company developments such as acquisitions, product launches, expansions, agreements, and partnerships of the leading players, the competitive landscape of the hemostats market to analyze market players on various parameters within the broad categories of business and product strategy. Top-down and bottom-up approaches were used to estimate the market size. To estimate the market size of segments and subsegments, the market breakdown and data triangulation were used.

The four steps involved in estimating the market size are

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information as well as assess prospects.

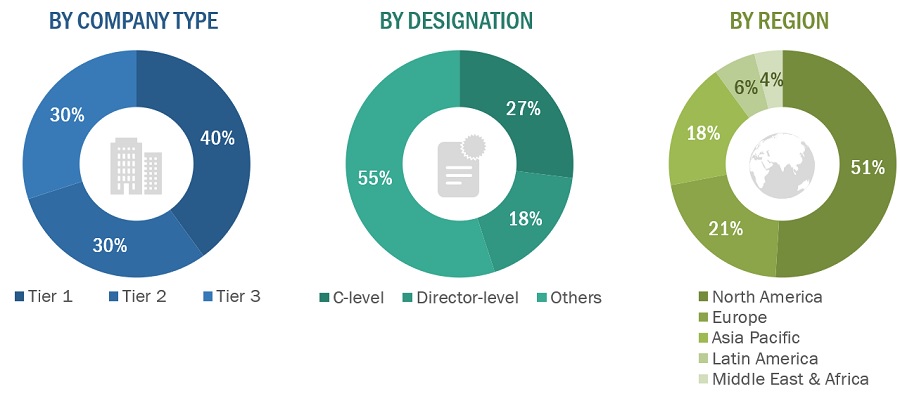

The following is a breakdown of the primary respondents:

Breakdown of Primary Participants:

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Companies are classified into tiers based on their total revenues. As of 2022, Tier 1 = >USD 100 million, Tier 2 = USD 10 million to USD 100 million, and Tier 3 = <USD 10 million.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Johnson & Johnson |

Regional Manager |

|

Baxter International |

Senior Product Manager |

|

Meril Life Sciences |

Marketing Manager |

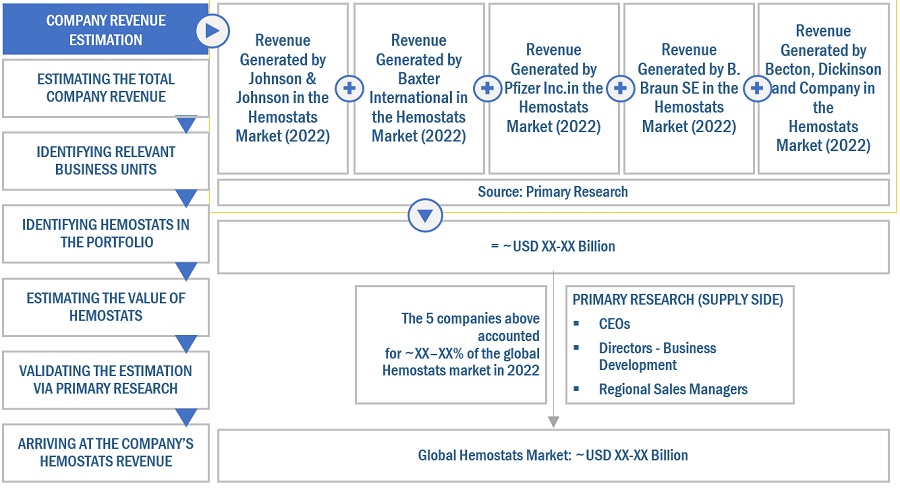

Market Size Estimation

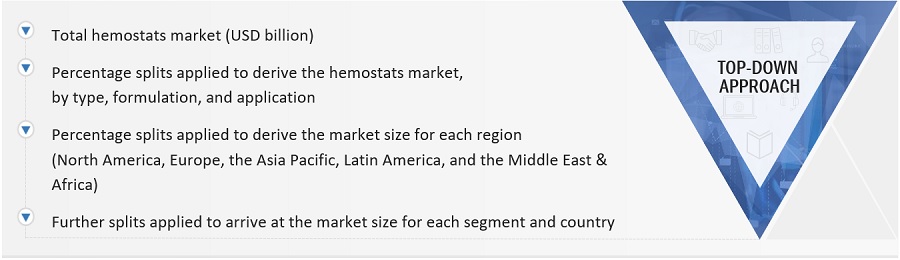

Both top-down and bottom-up approaches were used to estimate and validate the hemostats market's total size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research

- The revenues generated by leading players operating in the hemostats market have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Hemostats Market Size: Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Hemostats Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size by applying the process mentioned above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

When a blood vessel is damaged during surgery, the resulting blood loss must be stopped immediately. The process of stopping this bleeding is called hemostasis. Hemostats provide a temporary block by forming blood clots to control bleeding. The use of hemostats must be quick, localized, and carefully regulated. Hemostats are primarily required when the bleeding is heavy or the patient is suffering from congenital diseases or trauma defects.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, and forecast the hemostats market by type, formulation, application, and region

- To forecast the size of the hemostats market with respect to five regional segments: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall hemostats market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile the key players in the hemostats market and comprehensively analyze their market shares and core competencies in terms of market developments and growth strategies

- To track and analyze competitive developments such as product launches, agreements, collaborations, partnerships, and acquisitions in the hemostats market

- To benchmark players within the hemostats market using the Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offerings

Available Customizations

MarketsandMarkets offers the following customizations for this market report.

Country Information

- Additional country-level analysis of the hemostats market

Company profiles

- Additional five company profiles of players operating in the hemostats market.

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the hemostats market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Hemostats Market