Global Rheology Market: Overview

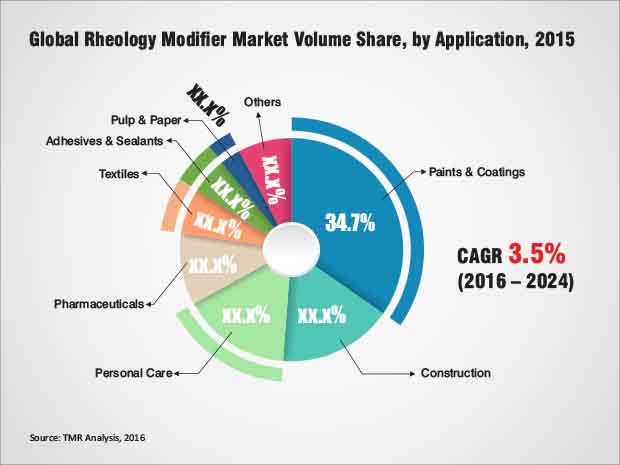

The primary application industries of the global rheology modifiers market include the paints and coatings industry and the personal care products industry. Both have been experiencing tremendous scope of growth recently and are expected to continue displaying a high growth rate. As a result, the demand for rheology modifiers is also expected to increase over the coming years, allowing key players to broaden their product profiles and for new players to gain entry into regional markets.

The top application industries of rheology modifiers are showing an accelerated growth rate in demand owing to the strengthening infrastructure in emerging economies, growing urban population densities, and quality improvements in rheology modifiers. Consumer goods and automotive and two industries that make wide use of theology modifiers, and are two industries currently showing a massive growth rate. They further provide fruitful ventures for players in the global rheology modifiers market.

Owing to these factors, the global rheology modifiers market is expanding at a CAGR of 3.7% between 2016 and 2024. It is expected to reach US$6.8 bn in 2024, after being recorded at US$4.9 bn in 2015.

Asia Pacific Holds the Largest Growth Opportunity for Rheology Modifiers Manufacturers

From a geographical perspective, Asia Pacific is showing a robust economic growth, coupled with a high population density that is steadily increasing its spending power on consumer goods. As such, it is the perfect ground for the global rheology modifiers market and its players to prosper.

The Asia Pacific construction and automotive industries are the strongest ones in the region. Both are showing massive growth rates over the coming years and both are major application industries of rheology modifiers. As a result, the Asia Pacific rheology modifiers market is showing a CAGR of 3.9% between 2016 and 2024. Within this region, the product segment of organic rheology modifiers is expected to show the faster growth rate and market size in 2024, as compared to inorganic rheology modifiers. In 2015, nearly 52% of the Asia Pacific rheology modifiers market was taken up by China, manifesting the strong industrial growth of the country. The country’s market share is expected to increase till 2024.

The North America rheology modifiers market stands to gain from upcoming construction projects in the region to drive itself. Apart from construction, sealants, personal care products, and paints and coatings are also expected to provide a significant scope of growth for rheology modifiers players. Meanwhile, Europe is showing a steady growth in its demand for rheology modifiers due to a growing concern over the use of clean raw materials and modifiers that are not detrimental to health.

Organic Rheology Modifiers Continue to Dominate Revenue Shares

With organic and inorganic being the two product segments in the global rheology modifiers market, about 63% was occupied by the organic segment in 2015. It is also expected to be the faster growing segment in the global rheology modifiers market in terms of both revenue generation and volume growth.

All major organic rheology modifiers – including polyurethane, guar gum, and xanthan gum – are heavily used in the industries of construction, pharmaceuticals, and paints and coatings, owing to their effectiveness and ease of production. On the other hand, inorganic rheology modifiers such as precipitated and fumed silica find major scope of use in adhesives, sealants, and pharmaceuticals. Most of the organo-clay based rheology modifiers find major use in personal care products and paints and coatings, which are the two top application industries for the global rheology modifiers market.

Rheology Modifiers Market to Observe Growth in Expanding Scope of Application in Several Industries

The demand for rheology modifiers is being driven by discovery of shale gas, rising production of crude oil, and its use in numerous applications around the world. Sealants and adhesives, paints and coatings, and cosmetics and personal care items all make use of rheology inhibitors. As a result, the global rheology modifiers market is being driven by rising demand from these uses.

Cosmetics and personal care, adhesives and sealants, paints & coatings, home care, oil & gas, pharmaceuticals, inks, and others are amongst the prominent applications for rheology modifiers. In terms of both value and volume, the personal care and cosmetics are likely to be a major contributor to the global rheology modifiers market. Rheology modifiers are mostly utilized as a thickener in a variety of personal care and makeup materials, such as toiletry items, foundations, skincare creams, and make-up items.

Extensive Use in the Liquid Paints for its Ability to Maintain Desirable Viscosity to Boost Demand

Rheology modifiers aid in maintaining the desired viscosity of liquid paint and it is essential for the purpose of liquid painting. Rheology modifiers also able to improve chemical bonding thereby causing liquid coating to be utilized in an extensive range of businesses. If the use of liquid coating increases, the demand for rheology modifiers is estimated to escalate in the coating industry. This factor is likely to boost the global rheology modifiers market in near future.

The demand for rheology modifiers is being held back by manufacturers' shifting preferences for advertising purposes in all continents. The growing acceptance of liquid coating on a variety of surfaces in various industries is likely to boost demand for rheology modifiers in the coating business. This factor is likely to create a scope of growth for the global rheology modifiers market. However, increased demand for various colours and compositions of solid deposits in the pigment or ink during the coating process is predicted to reduce the demand for the rheological modifiers and serve as a challenge for the global rheology modifiers market in the forthcoming years.

Table of Content

Chapter 1 Preface

1.1 Report Description

1.2 Report Scope

1.3 Assumptions

1.4 Market Segmentation

1.5 Research methodology

Chapter 2 Executive Summary

2.1 Global Rheology Modifiers Market, 2015–2024 (Kilo Tons) (US$ Mn)

2.2 Global Rheology Modifiers Market: Snapshot

Chapter 3 Industry Overview

3.1 Introduction

3.2 Value Chain Analysis

3.3 Market Drivers

3.3.1 Driver 1 - Rapid Growth in Global Paints & Coatings Industry to Boost Rheology Modifiers Market

3.3.2 Driver 2 - Demand for Personal Care Products to Propel Rheology Modifiers Market

3.3.3 Driver 3 - Increasing Demand from Adhesives & Sealants to Boost Rheology Modifiers Market

3.3.4 Driver 4 - Rising Demand from Pharmaceuticals to Drive Rheology Modifiers Market

3.3.5 Driver 5 - Rapid Growth of Construction Industry to Drive Rheology Modifiers Market

3.4 Restraints

3.4.1 Restraints 1 - Volatility in Crude Oil Prices is Expected to Affect the Prices of Rheology Modifiers

3.4.2 Restraints 2 - Volatility in Natural Gas Prices is Likely to Affect the Prices of Rheology Modifiers

3.4.3 Restraints 3 - Declining Consumption of Printing Inks Likely to Restrict Growth of Rheology Modifiers Market

3.5.1 Opportunity 1 - Rapidly Growing End-user Industry in Asia Pacific is Expected to Act as Opportunity for Industry Players in the Market

3.6 Porter’s Five Forces Analysis

3.7 Global Rheology Modifiers Market Attractiveness, by Application, 2015

3.8 Global Rheology Modifiers Market Attractiveness, by Country, 2015

3.9 Global Rheology Modifiers Market Share by Company, 2015

3.10 Applications Served by Key Industry Players

3.11 Product Portfolio of Key Industry Players

Chapter 4 Raw Material Price Trend Analysis

Chapter 5 Rheology Modifiers Market - Product Analysis

5.1 Rheology Modifiers Market: Product Segment Overview

5.1.1 Global Organic Rheology Modifiers Market, 2015–2024 (Kilo Tons) (US$ Mn)

5.1.2 Global Inorganic Rheology Modifiers Market, 2015–2024 (Kilo Tons) (US$ Mn)

Chapter 6 Rheology Modifiers Market – Application Analysis

6.1 Rheology Modifiers Market: Application Overview

6.1.1 Global Rheology Modifiers Market for Paints & Coatings, 2015–2024 (Kilo Tons) (US$ Mn)

6.1.2 Global Rheology Modifiers Market for Personal Care, 2015–2024 (Kilo Tons) (US$ Mn)

6.1.3 Global Rheology Modifiers Market for Adhesives & Sealants 2015–2024 (Kilo Tons) (US$ Mn)

6.1.4 Global Rheology Modifiers Market for Textiles, 2015–2024 (Kilo Tons) (US$ Mn)

6.1.5 Global Rheology Modifiers Market for Pharmaceuticals, 2015–2024 (Kilo Tons) (US$ Mn)

6.1.6 Global Rheology Modifiers Market for Construction, 2015–2024 (Kilo Tons) (US$ Mn)

6.1.7 Global Rheology Modifiers Market for Pulp & Paper, 2015–2024 (Kilo Tons) (US$ Mn)

6.1.8 Global Rheology Modifiers Market for Others 2015–2024 (Kilo Tons) (US$ Mn)

Chapter 7 Global Rheology Modifiers Market - Regional Analysis

7.1 Rheology Modifiers Market: Regional Overview

7.2 North America Rheology Modifiers Market, by Regional Sub-segment, 2015–2024

7.2.1 North America Rheology Modifiers Market, By Product Segment, 2015–2024 (Kilo Tons)

7.2.2 North America Rheology Modifiers Market, By Product Segment, 2015–2024 (US$ Mn)

7.2.3 North America Rheology Modifiers Market, By Application, 2015–2024 (Kilo Tons)

7.2.4 North America Rheology Modifiers Market, By Application, 2015–2024 (US$ Mn)

7.2.5 U.S. Rheology Modifiers Market, By Product Segment, 2015–2024 (Kilo Tons)

7.2.6 U.S. Rheology Modifiers Market, By Product Segment, 2015–2024 (US$ Mn)

7.2.7 US Rheology Modifiers Market, By Application, 2015–2024 (Kilo Tons)

7.2.8 US Rheology Modifiers Market, By Application, 2015–2024 (US$ Mn)

7.2.9 Rest of North America Rheology Modifiers Market, By Product Segment, 2015–2024 (Kilo Tons)

7.2.10 Rest of North America Rheology Modifiers Market, By Product Segment, 2015–2024 (US$ Mn)

7.2.11 Rest of North America Rheology Modifiers Market, By Application, 2015–2024 (Kilo Tons)

7.2.12 Rest of North America Rheology Modifiers Market, By Application, 2015–2024 (US$ Mn)

7.3 Europe Rheology Modifiers Material Market, by Regional Sub-segment, 2015–2024

7.3.1 Europe Rheology Modifiers Market, By Product Segment, 2015–2024 (Kilo Tons)

7.3.2 Europe Rheology Modifiers Market, By Product Segment, 2015–2024 (US$ Mn)

7.3.3 Europe Rheology Modifiers Market, By Application, 2015–2024 (Kilo Tons)

7.3.4 Europe Rheology Modifiers Market, By Application, 2015–2024 (US$ Mn)

7.3.5 UK Rheology Modifiers Market, By Product Segment, 2015–2024 (Kilo Tons)

7.3.6 UK Rheology Modifiers Market, By Product Segment, 2015–2024 (US$ Mn)

7.3.7 UK Rheology Modifiers Market, By Application, 2015–2024 (Kilo Tons)

7.3.8 UK Rheology Modifiers Market, By Application, 2015–2024 (US$ Mn)

7.3.9 Germany Rheology Modifiers Market, By Product Segment, 2015–2024 (Kilo Tons)

7.3.10 Germany Rheology Modifiers Market, By Product Segment, 2015–2024 (US$ Mn)

7.3.11 Germany Rheology Modifiers Market, By Application, 2015–2024 (Kilo Tons)

7.3.12 Germany Rheology Modifiers Market, By Application, 2015–2024 (US$ Mn)

7.3.13 France Rheology Modifiers Market, By Product Segment, 2015–2024 (Kilo Tons)

7.3.14 France Rheology Modifiers Market, By Product Segment, 2015–2024 (US$ Mn)

7.3.15 France Rheology Modifiers Market, By Application, 2015–2024 (Kilo Tons)

7.3.16 France Rheology Modifiers Market, By Application, 2015–2024 (US$ Mn)

7.3.17 Spain Rheology Modifiers Market, By Product Segment, 2015–2024 (Kilo Tons)

7.3.18 Spain Rheology Modifiers Market, By Product Segment, 2015–2024 (US$ Mn)

7.3.19 Spain Rheology Modifiers Market, By Application, 2015–2024 (Kilo Tons)

7.3.20 Spain Rheology Modifiers Market, By Application, 2015–2024 (US$ Mn)

7.3.21 Italy Rheology Modifiers Market, By Product Segment, 2015–2024 (Kilo Tons)

7.3.22 Italy Rheology Modifiers Market, By Product Segment, 2015–2024 (US$ Mn)

7.3.23 Italy Rheology Modifiers Market, By Application, 2015–2024 (Kilo Tons)

7.3.24 Italy Rheology Modifiers Market, By Application, 2015–2024 (US$ Mn)

7.3.25 Rest of Europe Rheology Modifiers Market, By Product Segment, 2015–2024 (Kilo Tons)

7.3.26 Rest of Europe Rheology Modifiers Market, By Product Segment, 2015–2024 (US$ Mn)

7.3.27 Rest of Europe Rheology Modifiers Market, By Application, 2015–2024 (Kilo Tons)

7.3.28 Rest of Europe Rheology Modifiers Market, By Application, 2015–2024 (US$ Mn)

7.4 Asia Pacific Rheology Modifiers Market, by Regional Sub-segment, 2015–2024

7.4.1 Asia Pacific Rheology Modifiers Market, By Product Segment, 2015–2024 (Kilo Tons)

7.4.2 Asia Pacific Rheology Modifiers Market, By Product Segment, 2015–2024 (US$ Mn)

7.4.3 Asia Pacific Rheology Modifiers Market, By Application, 2015–2024 (Kilo Tons)

7.4.4 Asia Pacific Rheology Modifiers Market, By Application, 2015–2024 (US$ Mn)

7.4.5 China Rheology Modifiers Market, By Product Segment, 2015–2024 (Kilo Tons)

7.4.6 China Rheology Modifiers Market, By Product Segment, 2015–2024 (US$ Mn)

7.4.7 China Rheology Modifiers Market, By Application, 2015–2024 (Kilo Tons)

7.4.8 China Rheology Modifiers Market, By Application, 2015–2024 (US$ Mn)

7.4.9 Japan Rheology Modifiers Market, By Product Segment, 2015–2024 (Kilo Tons)

7.4.10 Japan Rheology Modifiers Market, By Product Segment, 2015–2024 (US$ Mn)

7.4.11 Japan Rheology Modifiers Market, By Application, 2015–2024 (Kilo Tons)

7.4.12 Japan Rheology Modifiers Market, By Application, 2015–2024 (US$ Mn)

7.4.13 ASEAN Rheology Modifiers Market, By Product Segment, 2015–2024 (Kilo Tons)

7.4.14 ASEAN Rheology Modifiers Market, By Product Segment, 2015–2024 (US$ Mn)

7.4.15 ASEAN Rheology Modifiers Market, By Application, 2015–2024 (Kilo Tons)

7.4.16 ASEAN Rheology Modifiers Market, By Application, 2015–2024 (US$ Mn)

7.4.17 Rest of Asia Pacific Rheology Modifiers Market, By Product Segment, 2015–2024 (Kilo Tons)

7.4.18 Rest of Asia Pacific Rheology Modifiers Market, By Product Segment, 2015–2024 (US$ Mn)

7.4.19 Rest of Asia Pacific Rheology Modifiers Market, By Application, 2015–2024 (Kilo Tons)

7.4.20 Rest of Asia Pacific Rheology Modifiers Market, By Application, 2015–2024 (US$ Mn)

7.5 Latin America Rheology Modifiers Market, by Regional Sub-segment, 2015–2024

7.5.1 Latin America Rheology Modifiers Market, By Product Segment, 2015–2024 (Kilo Tons)

7.5.2 Latin America Rheology Modifiers Market, By Product Segment, 2015–2024 (US$ Mn)

7.5.3 Latin America Rheology Modifiers Market, By Application, 2015–2024 (Kilo Tons)

7.5.4 Latin America Rheology Modifiers Market, By Application, 2015–2024 (US$ Mn)

7.5.5 Brazil Rheology Modifiers Market, By Product Segment, 2015–2024 (Kilo Tons)

7.5.6 Brazil Rheology Modifiers Market, By Product Segment, 2015–2024 (US$ Mn)

7.5.7 Brazil Rheology Modifiers Market, By Application, 2015–2024 (Kilo Tons)

7.5.8 Brazil Rheology Modifiers Market, By Application, 2015–2024 (US$ Mn)

7.5.9 Rest of Latin America Rheology Modifiers Market, By Product Segment, 2015–2024 (Kilo Tons)

7.5.10 Rest of Latin America Rheology Modifiers Market, By Product Segment, 2015–2024 (US$ Mn)

7.5.11 Rest of Latin America Rheology Modifiers Market, By Application, 2015–2024 (Kilo Tons)

7.5.12 Rest of Latin America Rheology Modifiers Market, By Application, 2015–2024 (US$ Mn)

7.6 Middle East & Africa Rheology Modifiers Market, by Regional Sub-segment, 2015–2024

7.6.1 Middle East & Africa Rheology Modifiers Market, By Product Segment, 2015–2024 (Kilo Tons)

7.6.2 Middle East & Africa Rheology Modifiers Market, By Product Segment, 2015–2024 (US$ Mn)

7.6.3 Middle East & Africa Rheology Modifiers Market, By Application, 2015–2024 (Kilo Tons)

7.6.4 Middle East & Africa Rheology Modifiers Market, By Application, 2015–2024 (US$ Mn)

7.6.5 GCC Rheology Modifiers Market, By Product Segment, 2015–2024 (Kilo Tons)

7.6.6 GCC Rheology Modifiers Market, By Product Segment, 2015–2024 (US$ Mn)

7.6.7 GCC Rheology Modifiers Market, By Application, 2015–2024 (Kilo Tons)

7.6.8 GCC Rheology Modifiers Market, By Application, 2015–2024 (US$ Mn)

7.6.9 South Africa Rheology Modifiers Market, By Product Segment, 2015–2024 (Kilo Tons)

7.6.10 South Africa Rheology Modifiers Market, By Product Segment, 2015–2024 (US$ Mn)

7.6.11 South Africa Rheology Modifiers Market, By Application, 2015–2024 (Kilo Tons)

7.6.12 South Africa Rheology Modifiers Market, By Application, 2015–2024 (US$ Mn)

7.6.13 Rest of Middle East & Africa Rheology Modifiers Market, By Product Segment, 2015–2024 (Kilo Tons)

7.6.14 Rest of Middle East & Africa Rheology Modifiers Market, By Product Segment, 2015–2024 (US$ Mn)

7.6.15 Rest of Middle East & Africa Rheology Modifiers Market, By Application, 2015–2024 (Kilo Tons)

7.6.16 Rest of Middle East & Africa Rheology Modifiers Market, By Application, 2015–2024 (US$ Mn)

Chapter 8 Company Profiles

8.1 Air Products and Chemicals, Inc.

8.2 Akzo Nobel N.V.

8.3 Altana AG

8.4 Arkema S.A.

8.5 Ashland Inc.

8.6 BASF SE

8.7 Cargill Inc.

8.8 Clariant

8.9 Croda International plc

8.10 Diransa San Luis S.A.

8.11 The Dow Chemical Company

8.12 DuPont

8.13 Eastman Chemical Company

8.14 Elementis plc

8.15 The Euclid Chemical Company

8.16 Evonik Industries AG

8.17 FCC Inc.

8.18 Global Drilling Fluids and Chemicals Limited

8.19 Hangzhou Jingyi Chemical Co., Ltd.

8.2 The Lubrizol Corporation

8.21 Mallard Creek Polymers, Inc.

8.22 MÜNZING Group

8.23 PPG Industries, Inc.

8.24 San Nopco Limited

8.25 SNF Holding Company

Chapter 9 Primary Research- Key Findings

Chapter 10 List of Customers