Ready to Drink Tea & Coffee Market Share, Size, Trends, Industry Analysis Report, By Packaging (PET Bottle, Canned, Glass Bottle, Others); By Distribution channel; By Product; By Price; By Region; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 120

- Format: PDF

- Report ID: PM1147

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

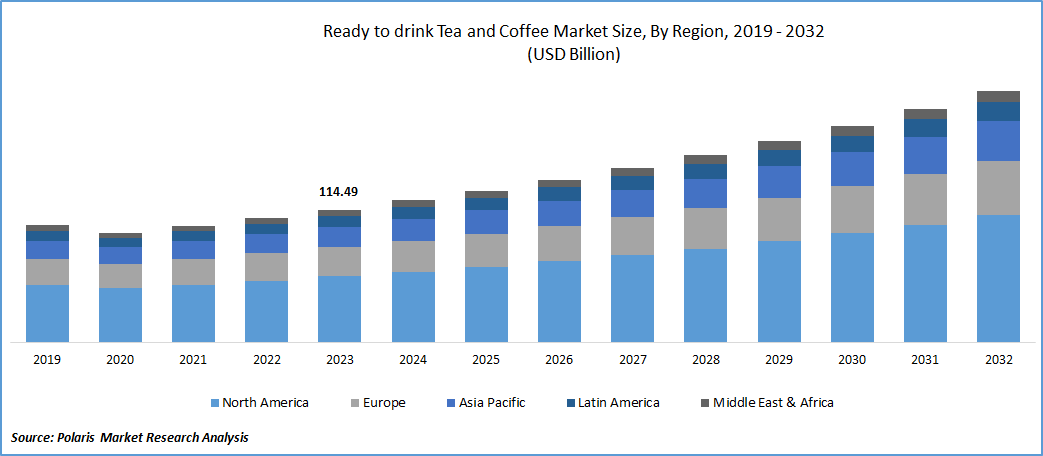

The global Ready to Drink Tea & Coffee market was valued at USD 114.49 billion in 2023 and is expected to grow at a CAGR of 7.4% during the forecast period.

The rising trend of on-the-go consumption, especially among urban dwellers and the younger demographic, has played a substantial role in driving market growth. Consumers are drawn to the extensive range of flavors and varieties offered in the ready-to-drink (RTD) tea and coffee segment, accommodating their diverse preferences. Additionally, the movement towards healthier and more convenient beverage options has emerged as a significant driver for market expansion.

As the trends in health and wellness continue to ascend, there is a notable emphasis on integrating functional ingredients, formulating natural and clean labels, making specific health claims, offering specialty varieties, and reducing sugar content in ready-to-drink (RTD) tea and coffee products. Although RTD tea and coffee is categorized as a soft drink, it distinguishes itself with proven health benefits. Evolving lifestyles, the promotion of on-the-go eating, and a growing preference for replacing meals with smaller nutritional snacks and drinks have driven the increased adoption of RTD tea and coffee. A shift away from carbonated drinks, fueled by growing consumer awareness of health concerns, also contributes to the market's expansion. Additionally, the market is shaped by a health-conscious population that values the antioxidant properties of RTD tea.

To Understand More About this Research:Request a Free Sample Report

Presenting RTD tea and coffee as recreational products has proven highly effective in capturing the interest of millennials, thereby amplifying the demand for the products. The swift socio-economic development witnessed over the past two decades has resulted in an increase in chronic health conditions such as cancer, heart disease, and diabetes. The health benefits associated with the consumption of RTD tea and coffee are drawing the attention of consumers, especially the aging population, further intensifying their preference for these beverages. A diverse range of RTD tea and coffee products is continually being introduced to the market, catering to the broad consumer base across various geographical locations.

- For instance, in April 2022, Lavazza, a renowned Italian coffee company, introduced a series of ready-to-drink (RTD) beverages specifically tailored for the U.S. market. This fresh lineup comprises four distinct styles: Classic Cold Brew, Nitro Cold Brew, Double Shot Cold Brew with Oat Milk, and Cappuccino Cold Brew with Milk. Each of these options will be crafted using Arabica coffee that is certified organic by the United States Department of Agriculture (USDA) and Rainforest Alliance-certified.

Nevertheless, unpredictable rainfall patterns and an escalation in the expenses associated with agricultural inputs contribute to a rise in the cost of raw materials, consequently elevating the overall cost of the final product. The comparatively higher cost of ready-to-drink (RTD) tea and coffee in comparison to traditional hot tea and ground coffee stands as a significant impediment to market growth. Furthermore, entrenched habits of consuming hot tea and coffee pose a constraint on the expansion of the market. A crucial and indispensable factor for success in the industry is the establishment of an extensive distribution network across diverse geographical regions by major players, enabling them to supply the product to a large consumer base.

Industry Dynamics

- Growth Drivers

- Variety in Flavor Profiles and Premiumization

The market for ready-to-drink tea and coffee thrives thanks to its diverse range of available flavors. Manufacturers consistently innovate, introducing a wide spectrum of flavors that cater to various taste preferences and cultural influences. From traditional black tea and classic coffee to exotic fruit-infused teas and indulgent mocha coffee blends, the choices are continually expanding. This extensive variety not only attracts new consumers but also encourages existing customers to explore and experiment with different offerings. Furthermore, the trend toward premiumization has shifted the perception of ready-to-drink tea and coffee from a simple convenience product to a sophisticated and upscale beverage choice. Single-origin coffee blends, Artisanal cold brews, and handcrafted tea concoctions have garnered a dedicated following among connoisseurs who are willing to pay a premium for high-quality and exclusive taste experiences.

Report Segmentation

The market is primarily segmented based on packaging, product, distribution channel, price, and region.

|

By Packaging |

By Product |

By Distribution Channel |

By Price |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Packaging Analysis

- The PET Bottle segment held the largest revenue share in 2023

The increasing popularity of this packaging type can be attributed to its convenient handling and cost-effectiveness. Additionally, the adaptability of PET bottles to be shaped in different sizes, forms, and colors has resulted in widespread adoption by many manufacturers. These manufacturers utilize appealing packaging solutions to attract consumer attention and offer an authentic and luxurious experience with their high-quality products.

PET bottles come with various advantages, such as breakage resistance in contrast to glass alternatives, high durability, and a reduced consumption of resources like energy, time, and manufacturing costs compared to glass bottles. Their recyclability and reusability fuel the growing demand for PET bottles in packaging ready-to-drink tea and coffee. PET bottles can be easily repurposed into various secondary products, such as carpet fibers, tote bags, pillow stuffing, and strapping materials. The lightweight properties of plastic bottles also lead to lower transportation costs to recycling centers. Consequently, the multitude of benefits associated with PET bottles relative to other packaging types contributes to their overall Ready to Drink Tea & Coffee market growth.

Canned packaging segment will grow drastically and is poised for significant growth in the forecast period. This expansion is fueled by factors like flavor preservation and prolonged product shelf life, providing increased convenience for consumers. Manufacturers choose canned packaging as it plays a role in improving the brand image of the product in the minds of consumers.

By Distribution Channel Analysis

- The Supermarkets/Hypermarkets segment accounted for the highest market share during the forecast period

The changing retail scenario and the emergence of supermarket chains, especially in smart cities such as India, are boosting the sales of RTD tea and coffee through this distribution channel. Additionally, the generous shelf space in supermarkets/hypermarkets has played a significant role in the strong sales of RTD tea and coffee through this channel.

The evolution of the food service industry as a distribution channel has attracted the interest of numerous manufacturers. The foodservice distribution channel comprises a network of distributors supplying products to cafeterias, hotels, restaurants, industrial caterers, and more. The growing trend of cafés and grab-and-go concepts worldwide is expected to contribute to the increased demand for RTD tea and coffee products through these channels.

The online distribution segment is poised for rapid growth throughout the forecast period. Increasing internet penetration among consumers, coupled with targeted consumer marketing efforts by companies, is expected to drive the expansion of this segment. Robust promotional activities by product manufacturers on various social media platforms contribute to market growth. Additionally, through online retail platforms, consumers can easily place orders, while product manufacturers and vendors can reach audiences in remote locations. With an online presence, product manufacturers and vendors can operate at minimal expenses and allocate more resources to research and development activities for product improvement.

Regional Insights

- Asia Pacific dominated the largest market in 2023

Countries with notable tea and coffee plantations, including India, China, and Japan, are propelling the demand for the product in the region. The Asia Pacific region is poised for substantial growth in the forecast period, particularly in economies like Indonesia and Thailand. Furthermore, the expanding presence of modern grocery retail chains in ASEAN countries, such as Malaysia, Thailand, Indonesia, and the Philippines, is bolstering the sales of RTD tea and coffee, contributing to anticipated significant growth in the years ahead.

The RTD tea and coffee industry in the Middle East and Africa is anticipated to experience significant growth with a high CAGR. The evolving retail scenario, combined with the substantial consumption of these products, is expected to contribute to increased RTD product consumption in the region. Additionally, the expanding food service sector in this region could further elevate the demand for RTD tea and coffee. Manufacturers are introducing variants infused with fruity and floral flavors like apple, peach, orange, rose, and lavender, along with enhanced taste using plant-based milk, which is projected to drive the demand.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- AriZona Beverages USA

- Asahi Group Holdings, Ltd.

- Danone

- Monster Energy Company

- Nestlé

- PepsiCo

- Starbucks Coffee Company

- Suntory Holdings Limited

- The Coca Cola Company

- Unilever

Recent Developments

- In December 2022, MatchaKo unveiled the inaugural premium matcha beverage in the ready-to-drink (RTD) category, achieving certifications for organic, vegan, and Non-GMO. Positioned as a healthier alternative with lower calorie content compared to sugary beverages, it stands out as the only shelf-stable matcha drink holding both organic and non-GMO certifications. The matcha utilized in this beverage is sourced from Japan and is of exceptional ceremonial-grade quality.

- In April 2022, Red Diamond Coffee & Tea broadened its ready-to-drink (RTD) tea offerings by introducing an 11-oz. bottle, aiming to enrich its product range and fill size gaps. The new single-serve bottles contain only two or three ingredients, incorporating water, tea leaves, and either sugar or Splenda for the sweetened variations. Notably, the company refrains from using concentrate or preservatives in their RTD teas.

Ready to Drink Tea & Coffee Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 122.32 billion |

|

Revenue forecast in 2032 |

USD 216.93 billion |

|

CAGR |

7.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Packaging, By Product, By Distribution Channel, By Price, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

Ready to Drink Tea & Coffee Market report covering key segments are packaging, product, distribution channel, price, and region.

Ready to Drink Tea & Coffee Market Size Worth $ 216.93 Billion By 2032

The global Ready to Drink Tea & Coffee market is expected to grow at a CAGR of 7.4% during the forecast period.

Asia Pacific is leading the global market.

The key driving factors in Ready to Drink Tea & Coffee Market are Variety in Flavor Profiles and Premiumization.